Are Revolving Accounts More Powerful Than Installment Accounts?

Revolving accounts and installment accounts are both important account types when building credit, but they are not equally powerful when it comes to your credit score. Which type of account has a greater impact on your credit score? Keep reading to find out.

Revolving Debt vs. Installment Debt: Definitions

Revolving Credit Account Definition

A revolving credit account is an account that allows you to “revolve” a balance, which means you do not have to pay the full outstanding balance on the account every month.

Revolving accounts typically have a credit limit up to which you can charge up to. You can choose how much to borrow from the account; you do not have to use the full credit limit. Once you make payments against the balance, that amount of credit is then available for you to use again.

Revolving accounts include lines of credit and credit cards.

Installment Credit Definition

Installment credit, in contrast, is credit where the full loan amount is disbursed at one time. You then make regular payments of a fixed amount toward the debt over a certain period of time.

Installment debt includes mortgages, auto loans, student loans, personal loans, credit-builder loans, and any other type of loan that has a regular payment schedule of fixed payments.

How Installment and Revolving Debts Affect Your Credit Score

Revolving Accounts and Your Credit Score

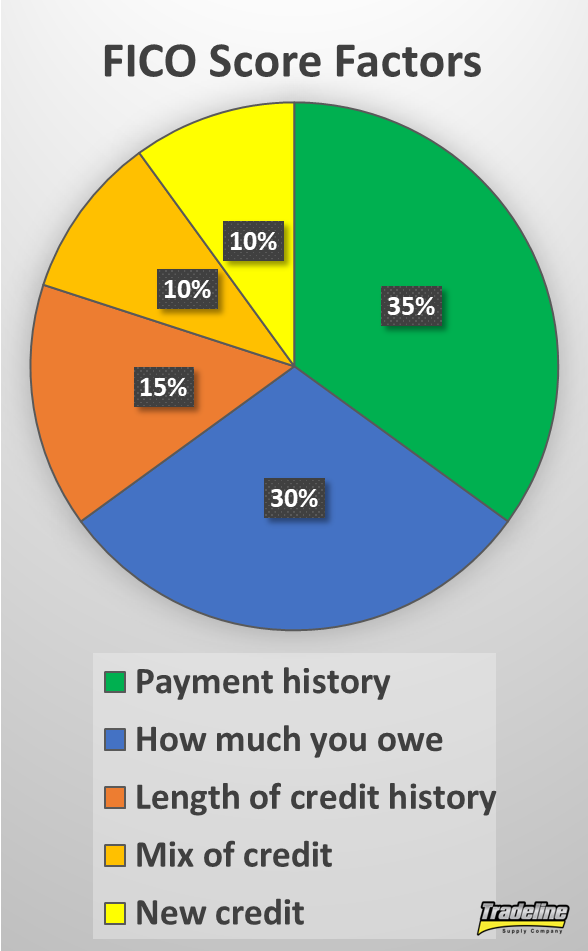

Five main factors are considered by FICO scores.

As you know from our article on credit scores, there are five main factors that influence your FICO score:

Payment history, 35%

Utilization/how much you owe, 30%

Length of credit history (age), 15%

New credit/inquiries, 10%

Credit mix, 10%

Revolving accounts can have a significant effect on each of these five factors.

As far as payment history, it’s important to pay your bills on time every single month just like any other account. However, with revolving accounts, you do not have to pay off the full balance every month. Instead, there is likely a minimum payment amount that you will be required to make. If you make a payment that is less than the minimum payment, your account will still be considered delinquent.

A lot of the power of revolving accounts comes from their influence on your utilization. This is because the credit utilization factor of your credit score places much more importance on the utilization of your revolving accounts.

Having high revolving utilization means that you are using a large portion of your available credit, which indicates to lenders that you might be at an increased risk of default. That’s why high credit utilization is bad news for your credit score.

If you run up a balance on a credit card and then only pay the minimum payment each month, you will be increasing your credit utilization. Since utilization makes up 30% of your FICO score, carrying a balance on your revolving accounts can seriously reduce your score.

Credit age is also important since it goes hand-in-hand with payment history. The longer you keep your revolving accounts open, the better. Even after they are closed, they can still continue to age and impact your average age of accounts.

Having a few different revolving accounts is also beneficial to your credit mix. Consumers with FICO scores of 785 and up have an average of seven credit cards in their credit files, including both open and closed accounts. In fact, if you don’t have enough revolving accounts, you can get dinged for a “lack of revolving accounts,” because without them there is not enough information to judge your creditworthiness, according to Discover.

Having too many inquiries for revolving accounts or too many new revolving accounts can hurt your credit score. Typically, each application for a revolving account is counted as a separate inquiry.

Installment Loans and Your Credit Score

When it comes to your credit score, installment loans primarily impact your payment history. Since installment loans are typically paid back over the course of a few years or more, this provides plenty of opportunities to establish a history of on-time payments.

Since installment loans typically don’t count toward your utilization ratio, you can have a high amount of mortgage debt and still have good credit.

Having at least one installment account is also beneficial to your credit mix, and installment debt can also impact your new credit and length of credit history categories.

What installment loans do not affect, however, is your credit utilization ratio, which primarily considers revolving accounts. That’s why you can owe $500,000 on a mortgage and still have a good credit score. This is also why paying down installment debt does not help your credit score nearly as much as paying down revolving debt.

This is the key to understanding why revolving accounts are so much more powerful than installment accounts when it comes to your credit score. Credit utilization makes up 30% of a credit score, and that 30% is primarily influenced by revolving accounts, not installment accounts.

In addition, with a FICO score, multiple inquiries for certain types of revolving accounts (mortgages, student loans, and auto loans) will count as just one inquiry as long as they occur within a certain time frame. As an example, applying for five credit cards will be shown as five inquiries on your credit report, whereas applying for five mortgage loans within a two-week period will only count as one inquiry.

Why Are Revolving and Installment Accounts Treated Differently By Credit Scores?

Now that you know why revolving accounts have a more powerful role in your credit score than installment accounts, you might be wondering why these two types of accounts are considered differently by credit scoring algorithms in the first place.

According to credit expert John Ulzheimer in The Simple Dollar, it’s because revolving debt is a better predictor of higher credit risk. Since credit scores are essentially an indicator of someone’s credit risk, more revolving debt means a lower credit score.

Since revolving accounts like credit cards are usually unsecured, they are a better indicator of how well you can manage credit.

Why is it that revolving debt better predicts credit risk than installment debt?

The first reason is that installment loans are often secured by an asset such as your house or car, whereas revolving accounts are often unsecured. As a result, you are going to be less likely to default on an installment loan, because you don’t want to lose the asset securing the loan (e.g. have your car repossessed or your home foreclosed on). Since revolving accounts such as credit cards are typically unsecured, you are more likely to default because there is nothing the lender can take from you if you stop paying.

In addition, while installment debts have a schedule of fixed payments that must be paid every month, revolving debts allow you to choose how much you pay back each month (beyond the required minimum payment). Since you can decide whether to pay off your balance in full or carry a balance, revolving accounts are a better reflection of whether you choose to manage credit responsibly.

How to Use Revolving Accounts to Help Your Credit

Since revolving accounts are the dominant force influencing one’s credit, it is wise to use them to your advantage rather than letting them cause you to have bad credit.

Here’s what you need to do to ensure your revolving accounts work for you instead of against you:

Make at least the minimum payment on time, every time.

Don’t apply for too many revolving accounts and spread out your applications over time.

Aim to eventually have a few different revolving accounts in your credit file.

Keep the utilization ratios down by paying off the balance in full and/or making payments more than once per month. Use our revolving credit calculator to track your utilization ratios.

Avoid closing revolving accounts so that they can continue to help your credit utilization.

Revolving Accounts vs. Installment Accounts: Summary

Revolving accounts are given more weight in credit scoring algorithms because they are a better indicator of your credit risk.

Revolving accounts play the primary role in determining your credit utilization, while installment loans have a much smaller impact. High utilization on your revolving accounts, therefore, can damage your score.

With a FICO score, inquiries for installment loans are grouped together within a certain time frame, while inquiries for revolving accounts are generally all counted as separate inquiries. Therefore, inquiries for revolving accounts can sometimes hurt the “new credit” portion of your credit score more than inquiries for installment accounts.

Use revolving accounts to help your credit by keeping the utilization low and keeping the accounts in good standing.

Read more: tradelinesupply.com