Ask an Expert: Why don’t I have a perfect credit score?

Q. I have a credit score of 670. I don’t understand why it is so low. My wife and myself own a home with no mortgage. I have been employed by the same company since 1990. We have an emergency fund of $35,000. I carry a debit card from the bank we use. I have a best buy card but not used for 10 years. I have no other credit cards. My credit reports don’t have anything negative on them. One report didn’t show our current residence, and I am disputing that currently. So why is my credit score so low, I would think it should be near perfect?

Dear Reader,

You seem like a reliable borrower: you have no debts, a steady income, and even savings. Although all of these are an essential part of what lenders consider when issuing credit, they are not all taken into consideration to calculate your credit score.

Your credit score is calculated using data reported by your creditors to the credit bureaus. This data includes details about your financial behavior, such as credit card usage and payments. However, information about employment, marital status, or assets, like your savings account, does not affect your credit scores. Even an incorrect home address isn’t likely to affect your score. Credit bureaus use your home address to confirm your identity and to match information to you. Although it’s recommended to correct this kind of information, doing so won’t affect your score.

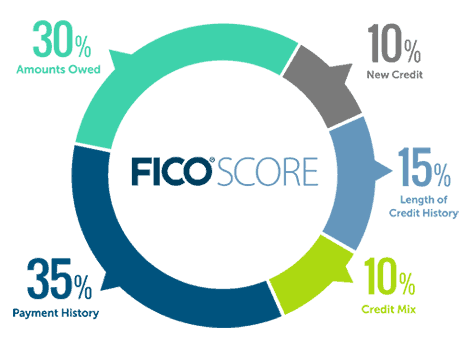

There several scoring models in the U.S. lending system. FICO is the most widely used scoring model, followed by VantageScore. We will be focusing on the FICO model, but keep in mind that the factors that influence both score models are more or less the same. FICO Scores takes into consideration the following to calculate your score:

1) Payment history (whether you pay credit lines on time and as agreed)

2) Utilization ratio (how much you owe compared to your available credit)

3) Age of your credit (for how long have you had credit)

4) Credit mix (the types of credit that you have)

5) New credit (how often you ask for new credit lines)

From what you tell us, it looks like your credit reports have no current activity. You haven’t used your Best Buy card in a while, your mortgage is paid off, and you don’t have other credit cards or loans. Because you don’t have monthly financial activities, it’s likely that your score stays more or less the same. The score you have now may be associated with the age and payment history of your Best Buy credit card and your paid-off mortgage, assuming that it is still included in your credit reports. Positive information about your mortgage will remain on your credit report for seven years after you made your last payment. After that time passes, by law, it will be removed from your credit history.

A perfect credit score is challenging to achieve. Experian calculates that only 1.2% of Americans have a perfect score of 850. But you don’t need a perfect score to get credit with the best terms and interest rates. A score above 700 is considered good enough for that. And your current 670 score is considered a good score. But, if you want to improve your score, there are strategies to help you do so.

Your first step is to add monthly financial activity to your credit report. A good way to do so is to get a credit card. You don’t have to get into new debt; instead, you can use it to pay for some of things you currently pay for with your debit card. To get your first card, do some research. There are plenty of credit cards in the market with reward programs and benefits. Just focus on finding one that meets your needs and doesn’t have an annual fee. Your current bank may be an excellent place to start looking.

Once you get your credit card, you have to learn how to use it strategically: always pay on time and, if possible, pay in full to avoid accumulating interest. Also, make sure you use 30% or less of your available credit line. The credit building journey is different from all of us. You already have solid financial habits, and boosting your score should only be a matter of consistency and time. If you would like a more personalized credit review and plan to work on your score, it’s always best to talk to an NFCC Certified Financial Counselor who can take a look at your report and give you the right recommendations based on your circumstances. Good luck!

Sincerely,

Bruce McClary, VP of Communications, NFCC

The post Ask an Expert: Why don’t I have a perfect credit score? appeared first on NFCC.

Read more: nfcc.org

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.