Things Everyone Should Know About Credit Cards

After all, credit cards are the most common form of revolving credit, which is given more importance than installment credit (e.g. auto loans, student loans, mortgages, etc.) when it comes to calculating your credit score.

Unfortunately, credit cards often get a bad rap because it’s easy to rack up excessive amounts of debt and destroy your credit score if you do not know how to use credit cards properly.

However, when you have the knowledge and ability to use credit cards to your advantage rather than to your detriment, they can be an extremely powerful financial tool to have in your arsenal.

If you’re unsure if using credit cards is the right choice for you or confused about how they work, then keep reading to learn the basics of credit cards that everyone should know.

What Is a Credit Card?

A credit card is a card issued by a lender that allows a consumer to borrow money from the lender in order to pay for purchases.

The consumer must later pay back the funds in addition to any applicable interest charges or other fees.

They can choose to either pay back the full amount borrowed by the due date, in which case no interest will be charged, or they can pay off the debt over a longer period of time, in which case interest will generally accrue on the unpaid balance.

Each credit card has an account number, a security code, and an expiration date, as well as a magnetic stripe, a signature panel, and a hologram. Most credit cards also now have a chip to be inserted into a chip reader rather than swiping the card at the point of sale. In addition, some credit cards offer contactless payment capability.

Credit cards allow consumers to pay for goods and services with funds borrowed from the credit card issuer.

How Do Credit Cards Work?

Although using credit cards may feel like using “fake money” or spending someone else’s money, it’s important to understand that the money you borrow when you pay with a credit card is very much real money that you now owe to the lender.

Credit Cards Are Unsecured Revolving Debt

With most credit cards, the funds you borrow are considered to be unsecured debt because you are borrowing the money without any collateral. That means the credit card issuer is taking on additional risk by giving you a credit card, since there is no collateral that they can take from you if you fail to pay back the debt, unlike with secured debt, such as a mortgage or a car loan.

Furthermore, the lender allows you to decide when and how much you want to pay back the funds instead of requiring you to pay the full balance on each due date. You can choose to only pay the minimum payment and “revolve” the remaining balance from month to month, which extends the amount of time during which you owe money to the credit card company.

Most credit cards now come with a chip in addition to a magnetic stripe.

For the above reasons, credit card interest rates are typically significantly higher than the interest rates for installment loans.

However, credit cards are also the only form of credit where paying interest is optional—there is a “grace period” of at least 21 days before the interest rate for new purchases takes effect, and you only get charged interest if you do not pay back your full statement balance by the due date.

(Keep in mind that the grace period usually only applies to new purchases, as stated by The Balance. This does not include balance transfers or cash advances, which typically begin accruing interest immediately.)

Understanding Credit Card Interest Rates

To reiterate, the interest rate of a credit card technically only applies when you carry a balance instead of paying off your full statement balance each month. However, most people will likely end up carrying a balance on one or more credit cards at some point, so it is still a good idea to be aware of what your interest rates are.

APR and ADPR

The interest rate of a credit card is usually expressed as an annual percentage rate (APR). This is the percentage that you would pay in interest over a year, which can be confusing because interest on credit card purchases is charged on a daily basis when you carry a balance from month to month.

You can find your average daily periodic rate (ADPR), which is the interest rate that you are being charged each day, by dividing the APR of your card by 365.

Average Credit Card Interest Rates

The interest rate of a credit card, expressed as the APR, is important to know if you ever carry a balance on the card.

As of October 2020, the average credit card interest rate as reported by The Balance is 20.23%. However, credit card issuers are allowed to set their APRs as high as 29.99%. It is not uncommon to see APRs upwards of 20%, even for consumers who have good credit.

The highest interest rates are generally seen on credit cards for bad credit or penalty rates that credit card issuers can implement when you are 30 or more days late to make a payment. You may also get penalized with a higher interest rate if you go over your credit limit or default on a different account with the same bank, according to ValuePenguin.

Ask for a Lower Interest Rate

In our article on easy credit hacks that actually work, we suggest trying the simple tactic of calling your credit card issuer’s customer service department and asking for a lower APR. Surveys have shown that a majority of consumers who do this are successful in obtaining a lower interest rate.

Important Dates to Know

Many consumers assume that the payment due date of your credit card is the only important date you need to worry about. While it’s true that the due date is the most important date to be aware of, there are several other dates that are useful to pay attention to as well.

Billing cycle

The billing cycle of a credit card is the length of time that passes between one billing statement and the next. All of the purchases you make within one billing cycle are grouped together in the following billing statement.

This cycle is typically around 30 days long, or approximately monthly, although credit card companies can choose to use a different billing cycle system.

Statement closing date

Your credit card’s statement closing date is not the same thing as your due date, so make sure you know both.

Sometimes referred to simply as the “closing date,” this is the final day of your billing cycle. Once a billing cycle closes and the statement for that cycle is generated, the balance of your account at that time is then reported to the credit bureaus.

You can look at your billing statement to find the closing date for your account. Because of the 21-day grace period, the statement closing date is usually around 21 days before your due date.

Due Date

This is the most important date to know in order to pay your bill on time every month, which is the most influential factor when it comes to building a good credit history. To make it easy for yourself to avoid accidental missed payments, you may want to set up automatic bill payments.

If your due date is inconvenient due to the timing of your income and other bills, you can try requesting a different due date with your credit card issuer.

Promotional offer dates

Many credit cards offer introductory promotions to attract new customers, such as 0% APR, bonus rewards, or no balance transfer fees. To use these offers strategically, you will need to know when the promotional period ends so you can plan accordingly.

Expiration date

All credit cards have an expiration date past which they cannot be used.

Every credit card has an expiration date printed on it, after which you will no longer be able to use that card, although your account will still be open. You just have to get a new credit card sent to you to replace the one that is expiring.

Usually, credit card companies will automatically send you a new card before the original card expires. If this does not happen, simply call the issuer to ask for a replacement credit card.

A Common Credit Card Mistake

Some consumers think that the closing date and the due date are the same thing and therefore believe that if they pay off the full statement balance by the due date, the credit card will report as having a 0% utilization ratio. They may then be confused to find out that their credit card is still reporting a balance to the credit bureaus every month.

However, the statement closing date is usually not the same date as your due date. This is why your credit cards may report a balance every month even if you always pay your bill in full—the account balance is being recorded on your statement date before you have paid off the card.

If you do not want your credit card to report a balance to the credit bureaus, you will need to either pay off the balance early, prior to the statement closing date, or pay your statement balance on the due date as usual and then not make any more purchases with your card until the next closing date.

Credit Card Payments

With credit cards, you have several different options for payment amounts.

Minimum payment

If you only pay the minimum payments on your credit cards, it will take longer to pay off your credit card debt and you will be charged interest.

This is the minimum amount that you are required to pay by your due date in order to be considered current on the account and avoid late fees. Although this may vary between different credit card issuers, typically the minimum payment is calculated as a percentage of your balance.

If you make only the minimum payment every month, it will take you a much longer time to pay off your balance and you will be paying a far greater amount in interest than if you were to pay off your statement balance in full. Check your billing statement to see how the math works out; the credit card company is required to disclose how long it will take to pay off the balance if you only make the minimum payments.

Statement balance

This is the sum of all of your charges from the preceding billing cycle in addition to whatever balance may have already been on the card before that cycle. This is the amount you need to pay if you do not want to pay interest for carrying a balance.

Current balance

This number is the total balance currently on your credit card, including charges made during the billing cycle that you are currently in, so it will be higher than your statement balance if you have made more purchases or transfers since your last closing date. You can pay this amount if you want to completely pay off your account so that it has no balance.

Other amount

You can also make a payment in the amount of your choosing, as long as it is greater than the minimum payment. This is a good option to use if you don’t have enough cash to pay the statement balance in full, but want to pay more than the minimum in order to mitigate the amount of interest you will be charged.

Credit Card Fees

Credit cards often charge various other fees in addition to interest. Here are some common fees to be aware of.

Although you may have access to a “cash advance” credit limit on your credit cards, it is generally not recommended to get a cash advance due to the high interest rates and fees you will have to pay.

Late payment fees

If you do not make the required minimum payment before the due date, the credit card company will likely charge you a late fee somewhere in the range of $25 – $40 (in addition to potentially raising your APR to a penalty rate). If you usually pay on time but accidentally miss a payment for whatever reason, try calling your credit card issuer and asking if they would be willing to reverse the fee since you have been an upstanding customer overall.

Annual fees

Some credit cards charge an annual fee for keeping your account open. Many times this charge may be waived for your first year as a promotional offer to attract new customers. Cards with higher annual fees will often have additional perks and rewards, but there are also plenty of great options for rewards cards that do not charge annual fees.

Cash advance fees

Your credit cards may give you the option to borrow cash in the form of a cash advance. However, this is usually not advised because cash advance interest rates are often significantly higher than your regular interest rate for purchases. In addition, you will most likely be charged a cash advance fee when you first withdraw the money, whether a flat dollar amount of around $10 or a percentage of the amount you take out, such as 5%.

Foreign transaction fees

Some cards charge a fee to use your card to pay for things in other countries. These fees are typically around 3% of the purchase amount. However, there are many credit cards on the market that do not charge foreign transaction fees.

Be sure to check the terms of service of your credit cards for fees such as these so that you can avoid any unexpected charges.

How Credit Cards Affect Your Credit

Credit cards are one of the most impactful influences on your overall credit standing, and they play a role in multiple credit scoring factors.

Building Credit With Credit Cards

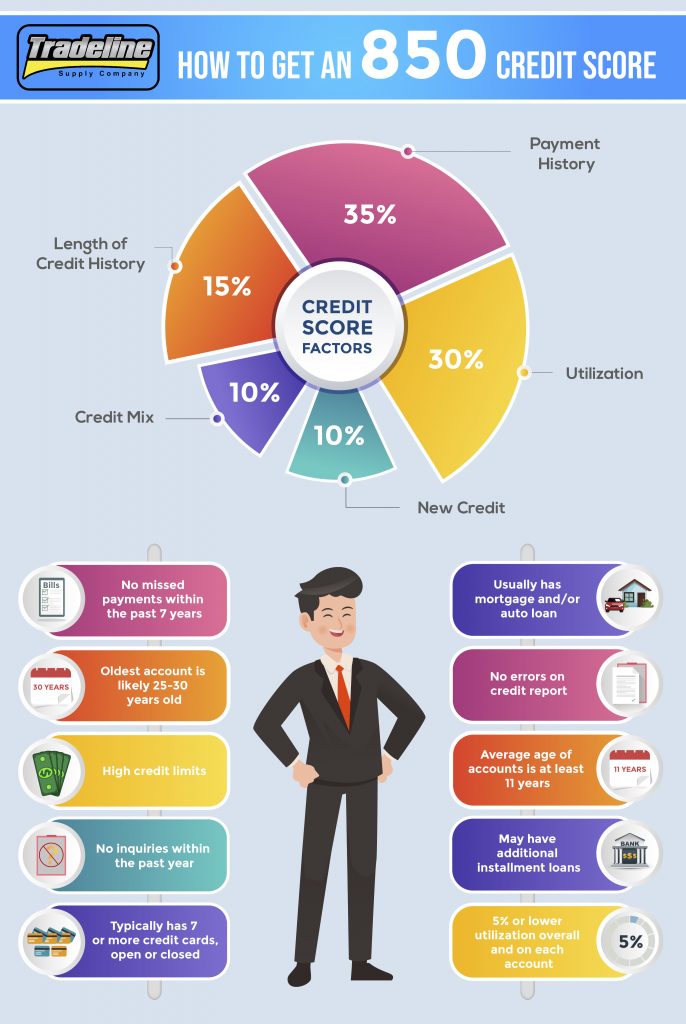

One of the major advantages of credit cards is that it allows you to start building a history of on-time payments, which is extremely important given that payment history is the biggest component of your FICO score, making up 35% of it.

All you have to do to get this benefit is use your credit card every so often and pay your bill on time every month.

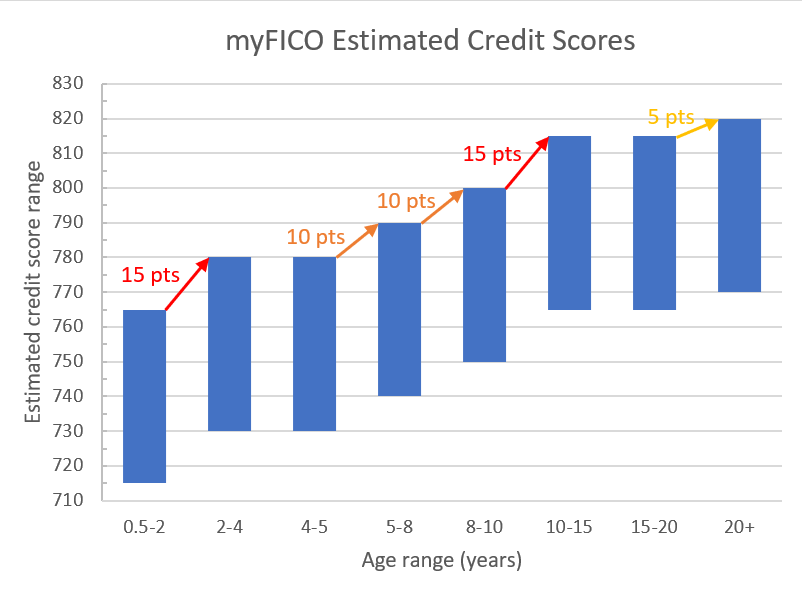

Click on the infographic to see the full-sized version!

Revolving Accounts Are More Important

We have previously discussed why revolving accounts are more powerful than installment accounts when it comes to your credit score.

Revolving accounts such as credit cards can have a much greater influence on your credit than auto loans, student loans, and even a mortgage—for better or for worse. They must be managed properly because negative credit card accounts will also have a very strong impact on your credit.

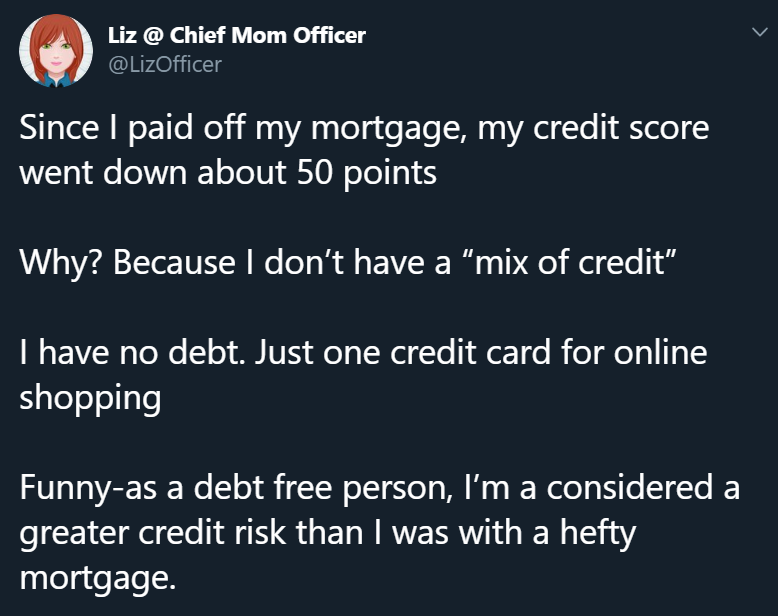

Mix of Credit

Although your mix of credit only makes up 10% of your FICO score, it is still worth considering, especially if you aim to achieve a high credit score or even a perfect 850 credit score.

A good credit mix generally includes various types of accounts, including both revolving and installment accounts. You can see the different types of accounts in our credit mix infographic.

Credit cards may help with your credit mix if you have a thin file or if you primarily have installment loans on your credit report.

They also add to the number of accounts you have, which is a good thing for the average consumer. In fact, as we talked about in How to Get an 850 Credit Score, FICO has stated that those who have high FICO scores have an average of seven credit card accounts in their credit files, whether open or closed.

The Importance of Credit Utilization Ratios

Your credit utilization is the second most important piece of your credit score, which is another reason why credit cards are such a strong influence on your credit.

The basic rule of thumb with credit utilization ratios is to try to keep them as low as possible (both overall and individual utilization ratios), meaning you only use a small portion of your available credit. Ideally, it’s best to aim to stay under 20% or even 10% utilization, because the higher your utilization rate is, the more it will hurt your credit instead of help.

Conclusions on Credit Card Basics

Credit cards can be intimidating, especially when you don’t know how to use them correctly.

It is also true that not everyone wants or needs to use credit cards.

It’s not impossible to build credit without a credit card, but it is more difficult since you would be limited to primarily installment loans, which are not weighed as heavily as revolving accounts, and possibly alternative credit data.

However, for those who are able to use credit cards responsibly and follow good credit practices, they can be an incredibly useful credit-building tool as well as a way to reap some benefits and perks that other payment methods do not provide.

We hope this introductory guide to credit cards provides the knowledge base you need in order to feel confident using credit cards and to take advantage of their benefits.

If you found this article useful, please comment to let us know or share it with others who want to learn more about credit cards!

Read more: tradelinesupply.com

It’s never a good feeling when you notice that your credit score has dropped. You might feel confused or concerned, and you would probably wonder why your credit score took a dip. Let’s explore some of the possible reasons that could cause your credit score to decline.

It’s never a good feeling when you notice that your credit score has dropped. You might feel confused or concerned, and you would probably wonder why your credit score took a dip. Let’s explore some of the possible reasons that could cause your credit score to decline.

Derogatory items on your credit report can be a big problem for your finances. These negative marks can stay on your

Derogatory items on your credit report can be a big problem for your finances. These negative marks can stay on your