Credit Builder Loan: A Loan That Works Backwords

Often people who need a loan are either short on cash or have immediate needs to be met. If that is the case for you, we recommend talking to a nonprofit credit counselor. If you are looking for a way to build credit or improve your credit score, we have a safe way for you to do that.

What if I told you there is a very popular loan product that does not let you access the cash until the end? You might wonder, “What is the purpose if you can’t access the money right away?” The purpose is in the name—Credit Builder Loan. If you need to build a positive credit profile, this product can help.

Whether we like it or not, a good credit history is crucial in today’s economy. Far more than just a number, a good credit score is a prerequisite for accessing everyday financial products like a credit card, a personal loan or auto financing. However, those with no credit history or a poor credit score have limited prospects. The task of establishing credit can be an unyielding catch-22: without credit, it is hard to get credit.

However, more and more nonprofit lenders and credit unions across the country are seeking to shift this restrictive paradigm by offering small dollar Credit Builder Loans (CBLs) that allow individuals to begin to build on-time payment history, with minimal risk and at a rate that is affordable and accessible to them. CBLs are designed to help consumers with no or thin credit files, or those with low scores but minimal outstanding current delinquencies, to establish and (re)build their credit histories and scores.

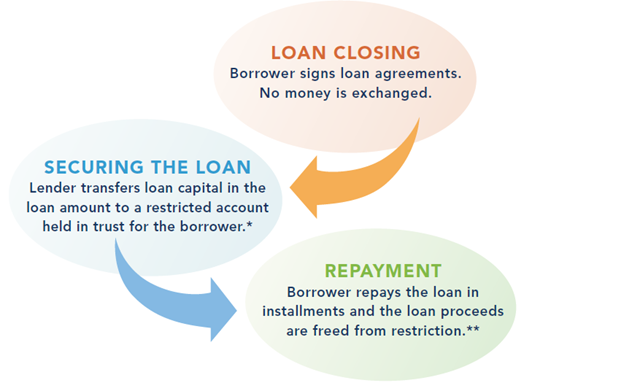

These small consumer loans are generally made using alternative underwriting criteria to assess borrowers’ ability and likelihood to repay. Which means if your credit report has no information or only negative information, you will not automatically be declined. Credit Builder Loans are unique in that they are purely for credit building purposes. The funds are secured in a restricted account by the lender and no money is exchanged up front. So, it functions like a backwards loan—you get the money at the end and not at the beginning.

The security, released when the loan is repaid, can often serve a second purpose of savings accumulation. The diagram below shows a typical version of the lending process.

Although terms (e.g. interest rates, fees, length, amount, etc.) may differ, CBLs are generally small dollar installment loans with terms ranging from 12 to 24 months. Some providers incentivize the loan program by matching the loan proceeds at maturity. To fulfill the core purpose of the loan, providers of CBLs must report complete payment histories on these loans to at least one major consumer reporting agency (CRA), such as Experian or TransUnion. Full reporting of payments enables borrowers to establish and build credit and better meet their financial goals.

How do you find a lender who offers a Credit Builder loan? One of the best consolidator sites can be found at a national non-profit called Credit Builders Alliance. This network of non-profit lenders and non-profits who are involved in financial coaching and counseling has a searchable find a member section where you can search by type of financial product. Just select “Credit Builder Loan” and you will find lenders located throughout the country.

Don’t let your lack of a positive credit history stop you from accessing needed credit—consider a Credit Builder Loan.

About the Author: Dara Duguay is the CEO of the Credit Builders Alliance.

The post Credit Builder Loan: A Loan That Works Backwords appeared first on NFCC.

Read more: nfcc.org

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.