How Much Should You Plan to Spend on Utilities Each Month?

One of the keys to financial success is keeping a balanced and predictable budget. The most important categories in that budget are those that are critical to your health and safety. Most utilities fit into this category. You’ll want to ensure that you know what to expect for these costs each month. And, you will want to actively seek ways to lower your utility bills if they take up too much of your monthly budget.

How much should you pay for utilities each month? It may be better to think in terms of a percentage of your income rather than a flat dollar amount.

Budgeting by Percentages and Defining “Utilities”

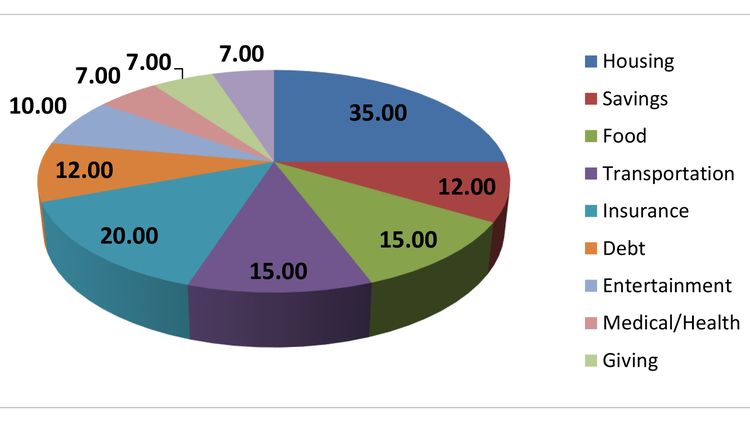

Conventional wisdom has been to budget according to percentages for each major spending category. Many experts have recommended for decades that consumers should spend less than 30 percent of their gross monthly income on housing, though some give a range like 25 to 35 percent. This may go back to a government standard introduced in the 1960s. Is this still relevant today? Maybe. It certainly can be a helpful guideline, though it is far from perfect.

An example percentage-based budget. Source: Michigan State University Extension.

A popular new budgeting approach is to use the 50/20/30 budget. In this model, housing is folded into your “basic needs,” which should be 50 percent of your income or less. This model may better reflect different costs of living in different locations.

Source: NerdWallet

However, neither of these methods account for utilities specifically. The “30 percent rule” really misses the mark here. Many experts have taken the 30 percent rule and added other categories like groceries, transportation, and insurance. All the categories are assigned a percentage, and together all the percentages add up to 100 percent. But often, no percentage is assigned to utilities. So, utilities fall under “housing.” This can be a problem because many people consider them to be two different expenses and may not account for utilities when calculating how much of a mortgage or rent payment they can afford. The 50/20/30 is better at accounting for utilities because it leaves a lot of wiggle room. However, it does not set a specific range for utility costs.

If you would like a specific rule to follow, then keep your utilities under 10 percent of your gross income. Though a good rule of thumb, ten percent is still pretty high, so think of it as a ceiling and keep the costs as low as you reasonably can. You should review the average monthly costs for common utilities in your area and budget for those amounts or more. Importantly, you must remember that your specific location and the square footage of your living space will determine how much you pay. But, knowing the average can be very useful to ensure that what you are paying is reasonable.

If you use the traditional budget percentages, remember that your 10 percent utilities budget is part of your housing budget. If you use 10 percent on utilities, that would leave only around 20 percent for your other housing costs. If you use the 50/20/30 budget, then the 10 percent is part of your 50 percent “needs” budget.

It might sound easy to keep utility costs under 10 percent of your income, but it is not easy for everyone. The less income you have, the higher the percentage of your budget you will devote to energy. The Natural Resources Defense Council reported in 2016 that low-income consumers were at risk of facing burdensome energy costs. That group had a “median energy burden” of 7.2 percent, meaning that a median of 7.2 percent of their monthly budget went toward energy costs.

This study only looked at “energy” expenses. It excluded water and secondary utilities like trash pickup and cable services. Therefore, once you add these additional expenses, it is easy to see how the costs could exceed 10 percent. Careful planning is important to limit your utility spending, especially when accounting for all utilities.

Budgeting for Your Total Utility Cost

To get an idea of what you should be paying for utilities, review your monthly bills, and cross reference them with these findings. You can also check with your local utility providers for more specific information, or consult with a realtor, neighbor, or anyone else who knows the specifics of your neighborhood.

Electricity

According to the most recent data from the U.S. Energy Information Administration, the average U.S. electric bill is $115.49. You can review all the data and look up the average for your state.

Water and Wastewater

A leading water-focused research group published a study last year, finding that the average bill in the U.S. for water and wastewater was $104 total.

Gas

Rocket Mortgage reported in 2017 that the average monthly gas bill was just above $55. It also reported state-by-state data that you can review.

Garbage Removal

The utilities listed so far are all necessities. Some homes may not use gas, but those that do rely on it for critical tasks like heat or cooking. There are other utilities that are very nice to have, but don’t quite rise to the level of being necessities.

One of those is garbage removal. You can probably expect to pay between $20 and $50 for garbage removal in most cases.

Phone, cable and Internet

Phone, cable and Internet costs are also not necessary and can vary widely. Unlike electricity, which costs more as you use more, typically these services charge a flat fee. The best way to save money is to pick the most affordable services upfront. These days, there are very low-cost cell phone plans, and many people choose to skip cable and opt for a cheaper streaming service instead. For Internet, you may be able to save money by opting for a slower speed, since oftentimes the upgraded plans do not make enough difference to warrant the cost.

For a family of two adults, a conservative budget for these expenses might be around $100 per month. However, these costs could easily creep to $200, $300 or more if you do not shop around, subscribe to many services, or opt for expensive options.

Making Changes

If you need to get your utility costs under control, the two best ways are to use less and to shop around. NerdWallet has put together 15 easy ways to lower your utility bills. Most of those focus on weatherproofing, stopping leaks, and so forth. Don’t forget about negotiating and checking prices with different companies. If it has been a while since you last shopped around for utilities, it may be worth doing so again to see if you can get better pricing than you are currently paying.

Another idea would be to get a roommate who could share the costs with you, though this will not be feasible for everyone.

Recap

Utilities can add up very quickly and take a big chunk of your budget. Unfortunately, many traditional budget models do not properly account for these costs. Try to spend no more than 10 percent of your monthly income on utilities, and take simple steps to lower these costs as low as you can.

If you are struggling to pay utility bills or other bills, contact a credit counselor who can work with you to figure out your best options moving forward and do a thorough review of your budget.

The post How Much Should You Plan to Spend on Utilities Each Month? appeared first on NFCC.

Read more: nfcc.org