Why Did My Credit Score Go Down?

Your average of accounts decreased because of a new account.

As we’ve written about many times in the articles in our Knowledge Center, the age of a tradeline is extremely important, as is your overall credit age. This is because credit age is linked to payment history, which is vitally important to your credit health.

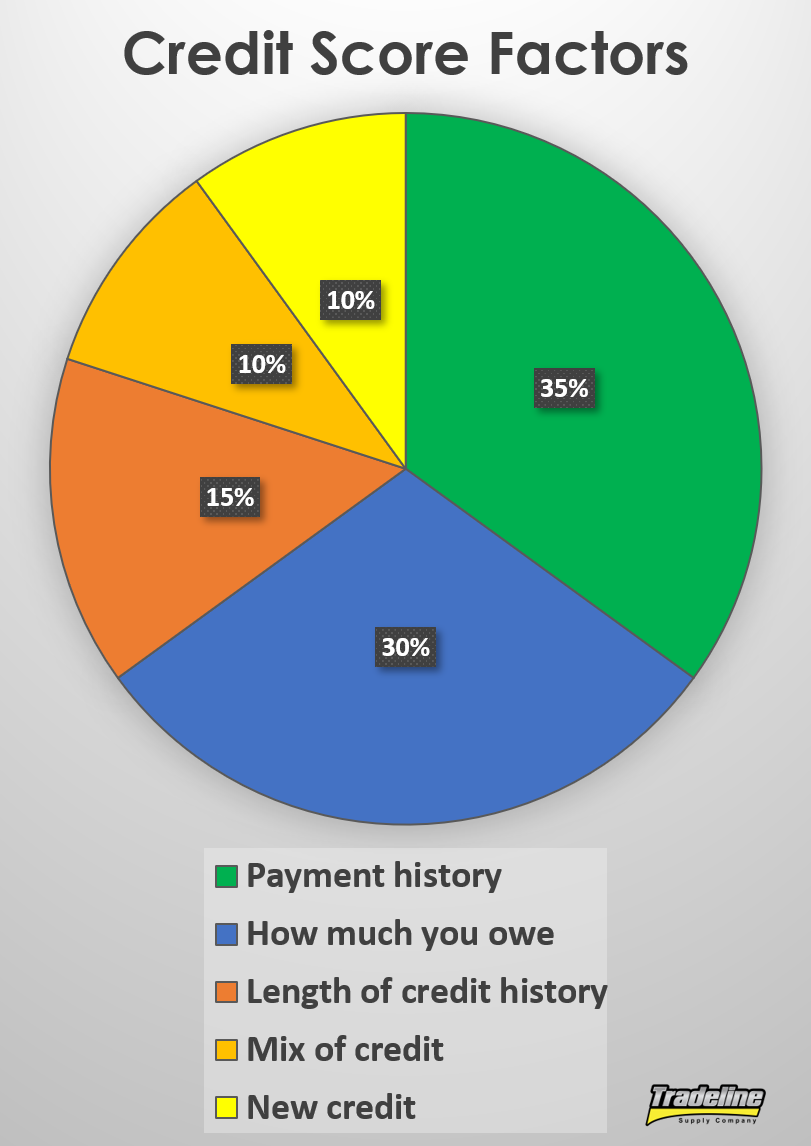

Payment history makes up 35% of your credit score and credit age contributes 15% to your score. When you add the two together, you get 50%, which means that half of your credit score is controlled by these two connected factors.

Within the credit age category, your average age of accounts is thought to be one of the most important variables. The more age your tradelines have, the more they can benefit your credit. Therefore, anytime you decrease your average age of accounts, you run the risk of your score decreasing as a result.

So if you recently opened a new primary tradeline or if you were added as an authorized user to an account that lacks age, the decrease in your average age of accounts might be what’s behind your credit score troubles.

Your account balances increased.

Did you use credit to make a large purchase recently? Have you been accumulating more debt by not paying the full balance you charged each month? If either of these scenarios is true for you, that could explain why your credit score took a dive.

As your account balances increase, so does your credit utilization rate. This is bad news for your credit score since credit utilization contributes about 30% of your score.

If you’ve been using your credit card more often without paying it off entirely each month, that could be the source of the change in your credit score.

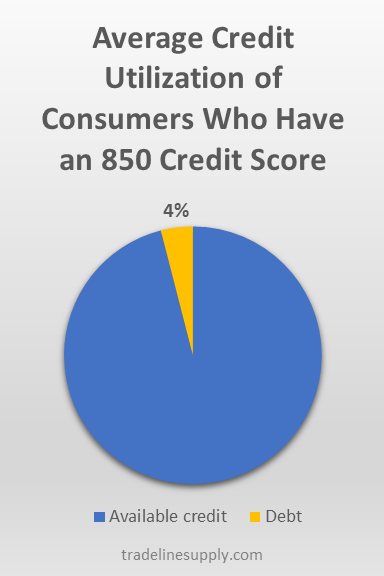

Low utilization is favorable since it indicates that you are not overextending yourself financially. On the other hand, high utilization shows that you are using a lot of your available credit, which means you are statistically more likely to default on a debt in the future. For this reason, high credit utilization is penalized by credit scoring models.

Fortunately, there are many strategies you can use to overcome the problem of high revolving credit utilization, such as pre-paying your credit card bill before your statement closing date, making more frequent payments throughout the month, increasing your credit limit, or getting a balance transfer card.

Read more about how to improve your utilization ratios in “What Is the Difference Between Individual and Overall Credit Utilization Ratios?”

You took out a loan.

When you open a new account, it can hurt your credit score for a few reasons. The first and most important reason is that the account has no age, which means it is going to negatively affect your average age of accounts.

In addition, there was likely a hard inquiry on your credit report as a result of applying for the new loan. In “Are Inquiries Really Killing Your Credit? What You Need to Know,” each recent hard inquiry on your report may affect your credit score by up to five points.

The new account may also have a negative impact on the “new credit” portion of your credit score. Having new credit makes you look like a riskier borrower, which means it could slightly reduce your score.

However, new credit only makes up about 10% of your credit score, so the impact of opening one new account would likely be relatively small and it would diminish over time.

You applied for credit but your application was denied.

Applying for a loan or credit card, whether your application is approved or denied, the resulting hard inquiry could damage your credit score slightly.

As we just mentioned, when you apply for credit, the lender usually has to do a hard pull (AKA a hard inquiry) on your credit report to see if you qualify.

This doesn’t always result in a new credit account being opened. Sometimes, for example, your credit application might get rejected by the lender, or perhaps you may choose to decline the terms you were offered and not proceed with opening the account. (Note, however, that when you apply for a credit card, typically the account is automatically opened when you get approved for the card.)

Unfortunately, even if you didn’t actually end up opening a new account, the fact that you applied for credit can still hurt your score. The hard inquiry still goes on your credit report whether you opened an account with that lender or not.

If you only applied for one account, then your credit score will likely only fall by a few points, if at all. If you applied for several accounts that you didn’t open within the past year, however, it’s possible that you could see a bigger dip in your score as a result of all of those inquiries on your report.

You missed a payment once or twice.

You might think that missing a payment here and there is not that big of a deal, but in reality, it can wreak havoc on your credit score. Recall that payment history is the most important factor contributing to your credit score, weighing in at 35% of your FICO score.

If you are 30 days late on making a payment even one time, this can have a significant detrimental effect on your credit, dropping your score by as much as 60 to 110 points.

If you still fail to make your payment by the following due date, then you get a 60-day late on your credit report, which hurts your credit even more.

30-day and 60-day lates are both considered minor derogatory items on your credit report, so they won’t mess up your credit as much as a major derogatory item.

However, if you get a 60-day late payment added to your credit report, do your best to catch up on payments before another 30 days pass, which is when things get even worse.

You missed a payment for three months in a row or more.

Missing a payment even once can seriously set back your credit score, but the damage will be even worse the longer you put off bringing the account current.

Once you reach 90 days past due on a credit account, that is now considered a major derogatory item, which is the worst possible type of item to have on your credit report. (Other major derogatory items include charge-offs, collections, foreclosures, settlements, judgments, repossessions, public records, and bankruptcies.)

Having a 90-day late on your credit report is certainly going to have a negative impact on your credit. A credit score drop from a major derogatory item will be even more severe and more difficult to recover from than that of a minor derogatory item. In addition, the major derogatory item could scare away potential lenders, making it harder to obtain credit in the future.

For more information on major and minor derogatory items and how they can affect your credit, see “What Is a Derogatory Item on Your Credit Report?”

One of your accounts went into collections.

If you default on a debt, meaning you did not fulfill your obligations to repay that debt, your creditor can sell your account to a collection agency, who will then try to collect the debt from you. A collection account is also a major derogatory item on your credit report, which means it can seriously hurt your score if you have an account go into collections.

Read our article on collections on your credit report to find out everything you need to know about collection accounts.

You applied for multiple credit cards in a short period of time.

Applying for multiple credit cards results in hard inquiries on your credit report, which can have a more significant impact on your score than just one inquiry.

Having too many hard inquiries on your credit report in a short period of time indicates that you are seeking a lot of new credit, which is a bad sign to lenders, and it will bring down your score.

With most credit scoring models, inquiries for credit cards are all counted separately, even if they were all around the same time. Since inquiries can each cost your credit score up to five points, that can add up quickly. (The exception to this is the VantageScore credit score, which counts all inquiries made within a 14-day window of each other as one inquiry, regardless of the type of account.)

Furthermore, if you got approved for and opened all of the accounts that you applied for, then you could also end up with too many new credit accounts on your credit report.

One of your credit cards was closed.

Many consumers mistakenly believe the credit myth that it will help their credit if they close some of their accounts. In a way, that makes sense, because it lowers the amount of available credit you have, which reduces the potential amount of debt you could get into if you were to use all of your available credit.

However, that is not how credit scores work, because unfortunately, credit scores don’t always make sense.

We dispel this common misconception and more in “Let’s Get to the Bottom of These Credit Myths.”

The truth is that closing an account almost always hurts your credit instead of helping it.

With revolving accounts, such as credit cards, closing an account reduces your total credit limit by removing the credit limit of that card. When you reduce your credit limit, that action increases your overall credit utilization ratio, meaning that you are now using a larger fraction of your available credit.

This hurts your credit score because having a high credit utilization ratio is penalized by the credit scoring algorithms, whereas maintaining a low utilization ratio is rewarded.

The worst-case scenario for your credit when closing an account is if the account is closed while it still has a balance on it. In this case, that individual account will look like it is maxed out or over the limit because it has a balance but no credit limit. That alone is enough to significantly harm your credit, and the increase to your overall utilization ratio only worsens the problem.

Depending on what else is in your credit file, closing a credit card could also negatively affect your credit mix, which could result in a small credit score drop.

On the plus side, the reason why an account was closed does not play a role in your score, so you won’t be affected more negatively if the card was closed by the issuer than if it was closed at your request.

For more information about closed accounts on your credit report, see “How Do Closed Accounts Affect Your Credit?”

There was fraudulent activity on your accounts.

Have you checked your credit card statements lately?

An unexpected decrease in your credit score could be the result of fraudulent activity on your accounts.

If you see any charges on your statement that you do not recognize, then it could be fraudulent activity that is bringing down your score. Perhaps someone was able to obtain your credit card information by phishing or through a data breach and used it to run up the balance on the card.

It’s important to monitor your credit accounts regularly so that you can catch any suspicious activity early on. Better yet, set up email or mobile notifications on your account that will alert you to fraudulent activity instantly.

If a criminal does manage to get access to your account, report the fraudulent charges to your credit card issuer immediately and ask to have the charges reversed. Most credit card companies have a zero liability policy, which means you won’t be held responsible for paying for any of the fraudulent charges.

You paid less than the minimum payment.

If your cash flow is tight, it can be tempting to send the bank or credit card company a partial payment instead of the full amount that is due that month. You may think that it’s not as big of a deal as not paying at all, because at least you are sending them some of the money.

Unfortunately, it doesn’t work that way. If you do not cover the full minimum payment by the due date, it will not be counted as an on-time payment.

If you can bring the account current before 30 days pass, you may still have to deal with a late fee from your credit card issuer (although it’s worth asking them to waive the fee), but at least the late payment will not show up on your credit report.

On the other hand, if you do not make a sufficient payment and 30 days go by, then you will have a late payment pop up on your credit report, which can definitely take a toll on your credit score.

To prevent this from happening, as soon as you know you will not be able to make the full payment, contact your credit card issuer and ask if they have a financial hardship program or try to negotiate an arrangement with them that allows you to pay what you can without damaging your credit.

You didn’t use your credit card for a long time.

Your credit card issuer might have closed your account if it had been inactive for a long time.

If you don’t use a credit card for a long period of time, it’s possible that your credit card issuer may decide to close your account due to the lack of activity.

As we discussed above, a closed credit card is bad news for your credit since the loss of available credit hurts your credit utilization and it may also damage your mix of credit.

According to The Balance, the credit card company is not required to give you advance notice if they plan to close your account, so it’s best to take proactive measures to prevent this from happening.

To avoid having your card closed due to inactivity, make sure you use it to make a purchase at least once every few months. An easy way to do this is to use the credit card to pay for a subscription service that renews each month. Then, set up automatic bill payments on your credit card and the whole process will be automated.

You finished paying off an installment loan.

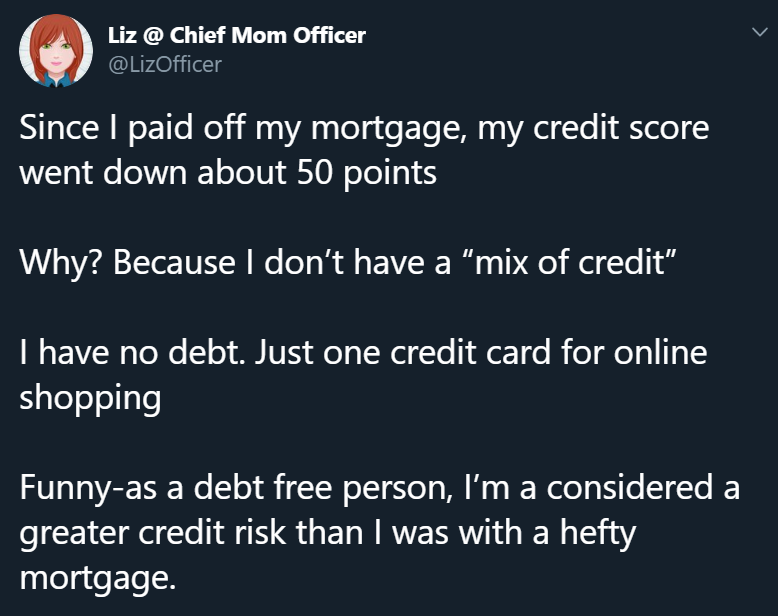

Making the final payment on your auto loan, student loans, or mortgage is an exciting accomplishment. Yet, when you finish paying off an installment loan, your credit score may decrease instead of increase.

Even though you now have less debt, which sounds like it would help your credit score, this may not outweigh the negative impact to your mix of credit. The paid-off installment loan will now report as a closed account, which can be harmful to your credit if all you have left is a few revolving accounts.

@LizOfficer shared a real-life example of this on Twitter.

This Twitter user commented that paying off her loan made her credit score go down since it affected her mix of credit.

An account that you are piggybacking on became delinquent.

Sometimes being an authorized user on a credit card or having a joint account can be a risky thing. You are relying on the other person to pay their bills on time and to manage their balances well, otherwise their behavior can compromise your credit.

In other words, an ideal tradeline should have a low utilization ratio, it should have a higher age than your average age of accounts and your oldest account, and most importantly, it needs to have a perfect payment history.

Therefore, you want to avoid being added as an authorized user to a tradeline that has any derogatory marks on it so that those derogatory items don’t get added to your credit file and end up damaging your credit.

That’s the danger of piggybacking on a friend or family member’s credit card—even if the tradeline is perfect when you are first added to it, there’s no guarantee that it will stay that way.

If your authorized user tradeline does get any missed payments on its record, that could definitely hurt your credit, and it would be smart to remove yourself from it immediately. To do so, simply call the credit card issuer and request to be removed from the account, as most banks allow you to do this without needing to go through the primary account holder.

Delinquency on the part of the primary account holder can cause problems if you are piggybacking on someone else’s credit account.

You declared bankruptcy.

Bankruptcy is one of the worst things you can have on your credit report. Since declaring bankruptcy essentially means you are asking to be released from the legal obligation to repay your debts, it shows lenders that you have an extremely high risk of defaulting in the future, so it can have a severe negative impact on your credit score.

There are inquiries on your credit file that you did not authorize.

Unauthorized inquiries on your credit file can unfairly drag down your credit. In our article on credit inquiries, we reported that each hard inquiry on your credit report can potentially cost you up to five points each.

Fortunately, you have the right to dispute any hard inquiries on your credit report that you did not authorize. You can learn more about the credit dispute process in “How to Fix the Most Common Credit Report Errors.”

Your credit file got merged with someone else’s.

Sometimes inaccurate information can get on your credit report not as a result of fraud or because your lender reported it incorrectly, but because your credit file accidentally became mixed with the information of another person.

This is called a “mixed credit file” or “mixed credit report” and it usually occurs with two consumers who have similar names.

If the credit history of the other consumer with whom your file has been mixed contains negative information, that would obviously be detrimental to your score, and you would need to correct the situation by filing a dispute with the credit bureau.

This is an example of why it’s important to check your credit report regularly. If there is incorrect information on your credit report that should be removed, you don’t want to find out about it when you’re trying to apply for credit. You need to catch and correct credit report mistakes early so that they don’t stand in the way of you achieving your financial goals.

You maxed out one or more of your credit cards.

Credit utilization makes up nearly a third of your FICO score, which means it’s critically important to keep your utilization low if you want to maintain a high credit score. Maxing out even just one credit card can have a significant negative impact, and if you max out multiple cards, you’ll be even worse off.

Check out our article on utilization ratios for tips on how to keep your utilization rate at an optimal level.

Someone opened an account in your name.

An account on your credit report that you don’t recognize could be an account that someone else fraudulently opened in your name.

We already covered how opening a new account can negatively affect your credit initially, but don’t forget that the same thing can happen if someone else uses your name to sign up for a new account.

If you see that your credit score has decreased, take a look at the inquiries and accounts on your credit report to see if there are any items that should not be there.

You have “double jeopardy” with collection accounts on your credit report.

Debt collection agencies are not known to be the most trustworthy entities and often do not have the best practices when it comes to keeping track of debts and contacting consumers. Information often gets lost or misrecorded when it is transferred between creditors and sometimes numerous collection agencies.

Because of this, some consumers find themselves with more than one entry for the same open collection account on their credit report, which is known as “double jeopardy.”

While the same collection may be listed multiple times due to the account changing hands, only the entity who currently owns the debt should be reporting the account as open.

Fortunately, if a collection is being reported in error, you can dispute the inaccurate information and have the information be corrected or potentially removed altogether.

Your credit report says you missed a payment even though you paid on time.

Dispute any mistakenly reported late payments so that they don’t unfairly affect your credit score.

Since payment history is the most important factor in your credit score, an incorrectly reported missed payment could severely damage your credit, especially if you are starting with very good credit. The higher your score to begin with, the more you stand to lose from a credit mistake.

This type of situation is another example that demonstrates why it’s so crucial to regularly check your credit report. If you always made all of your payments on time, you might assume that you must have a spotless credit record, only to find out at an inconvenient time that a creditor has been incorrectly reporting that you missed a payment.

Keep an eye out for errors like this on your credit report so that you can dispute them right away.

Your credit card issuer reduced your credit limit.

Sometimes, credit card issuers lower the credit limits of their cardholders, even for those who have consistently managed their accounts responsibly.

Unfortunately, they are usually allowed to do this without asking for your permission or letting you know in advance, so it may come as a nasty surprise when you swipe your credit card and get declined, or when your credit score takes a dive because your credit utilization is suddenly much higher.

There are a few reasons why your bank may reduce your credit limit, such as the following:

Credit card issuers sometimes cut credit card limits, which hurts your credit utilization ratio.

Your balances have been increasing, which indicates that you are taking on more debt and might be at a greater risk of defaulting.

You missed a payment and your account becomes delinquent.

Your account was inactive because you did not use your credit card enough.

The economy is down and lenders want to minimize their risk exposure levels.

Regardless of why your credit limit took a hit, the result is the same: with less available credit, your credit utilization increases, which is bad for your score.

If your credit card issuer slashed your credit limit, check out “How to Increase Your Credit Limit” for some useful tips, and don’t be afraid to give your bank a call to ask them to reconsider.

A collection account was deleted from your credit report.

Surprisingly, it is actually possible that getting a collection account removed from your credit report could make your credit score go down instead of up.

We talk about this in greater detail in “Collection Accounts on Your Credit Report: The Ultimate Guide” and “What Are Credit Scoring ‘Buckets?’” by credit expert John Ulzheimer, but the basic idea is that there are different credit scoring “buckets” that have slightly different methods of calculating credit scores for the consumers within each bucket.

By removing a collection account from your credit report, it is possible that you could move from one bucket into another bucket where your score will now be calculated differently. As a result of this new algorithm being applied to your credit report, your score could turn out to be lower than it was when you were in the first bucket.

You haven’t used any credit in a long time.

If you have used credit in the past but not recently, some of your old accounts may have fallen off of your credit report altogether. Accounts that are closed or inactive do not stay on your credit report forever. Positive accounts will generally stay on your credit report for 10 years, whereas negative accounts may stay on your credit report for up to 7 years.

When these old accounts age off of your credit report, you lose all of the credit history associated with them, the most important of which is the payment history. Because you are losing valuable credit history, your score could take a hit.

Those with thin credit files or those who have not used credit in several years will need to focus on building credit in order for their credit score to recover.

Conclusions

When it comes to your credit score, minor fluctuations are normal, so there’s generally no need to fret about losing a few points here and there.

If you are practicing good credit habits and paying all of your bills on time, it’s probably not necessary to watch your credit like a hawk and check your score every single week, and a change of a few points in either direction should not cause you to panic.

However, as we have seen, you don’t want to neglect your credit entirely, since mistakes can and do happen.

In addition, keep in mind that credit moves can sometimes have unexpected results, particularly in cases where you may be migrating from one credit scoring “bucket” to another.

If you see a significant drop in your credit score, that is definitely worth investigating further so that you can understand why it happened, address the issue, and hopefully get some of those credit score points back.

Read more: tradelinesupply.com

The FCRA entitles you to review your credit file from each of the three main credit bureaus for free once every 12 months. You can do one check every four months from each of the three — Equifax, Experian and TransUnion — if you really want to be on top of it.

The FCRA entitles you to review your credit file from each of the three main credit bureaus for free once every 12 months. You can do one check every four months from each of the three — Equifax, Experian and TransUnion — if you really want to be on top of it.

Balance transfers are a somewhat controversial topic in the world of

Balance transfers are a somewhat controversial topic in the world of

In the world of consumer credit, there are a number of Federal laws or “statutes” which help consumers in regards to their personal credit. Two such notable statutes are the Fair Credit Reporting Act, more commonly referred to as the “FCRA”, and the Credit Card Accountability, Responsibility, and Disclosure Act of 2009, more commonly referred to as the “CARD Act.”

In the world of consumer credit, there are a number of Federal laws or “statutes” which help consumers in regards to their personal credit. Two such notable statutes are the Fair Credit Reporting Act, more commonly referred to as the “FCRA”, and the Credit Card Accountability, Responsibility, and Disclosure Act of 2009, more commonly referred to as the “CARD Act.”

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.