Credit-Builder Loans: Can They Help You?

What Is a Credit-Builder Loan?

If you have bad credit or no credit at all, you’ll likely have a hard time getting a loan. After all, the paradox of credit is that it’s hard to get credit without already having a credit history, much like trying to get a job without any work history.

A credit-builder loan can be a good option for those with no credit or bad credit because credit-builder loans do not require the borrower to have good credit to get approved. However, you will need to show that you have enough income to cover the monthly payments.

Just like a traditional loan, your payment history will be reported to the major credit bureaus. That means you need to make all of your payments on time if you want to build up your credit score.

How Do Credit-Builder Loans Work?

Credit-builder loans, also sometimes called “fresh start loans” or “starting over loans,” are set up differently than traditional loans in order to minimize risk for lenders.

These loans are typically small amounts, such as $500 or $1000. In addition, unlike other types of loans, you do not receive the money upfront and pay it back later. Instead, this process is reversed.

The definition of a credit-builder loan is a loan where you make the payments first and receive the funds after you have finished paying off the loan. The lender deposits the amount you are borrowing into a savings account or certificate of deposit that will be held for you until you finish making all the payments. Until that point, you can’t access the funds.

Do You Need a Credit Check to Get a Credit-Builder Loan?

Because credit-builder loans are low-risk, in many cases, you can apply for credit builder loans with no credit check. You’ll likely just need to provide your income to prove that you can afford to make the payments.

Banks That Offer Credit-Builder Loans

Most of the big national banks, such as Chase, Bank of America, and Capital One, do not typically offer credit-builder loans, although Wells Fargo offers secured personal loans.

The best credit-builder loans can often be found at local banks and credit unions or through online lenders.

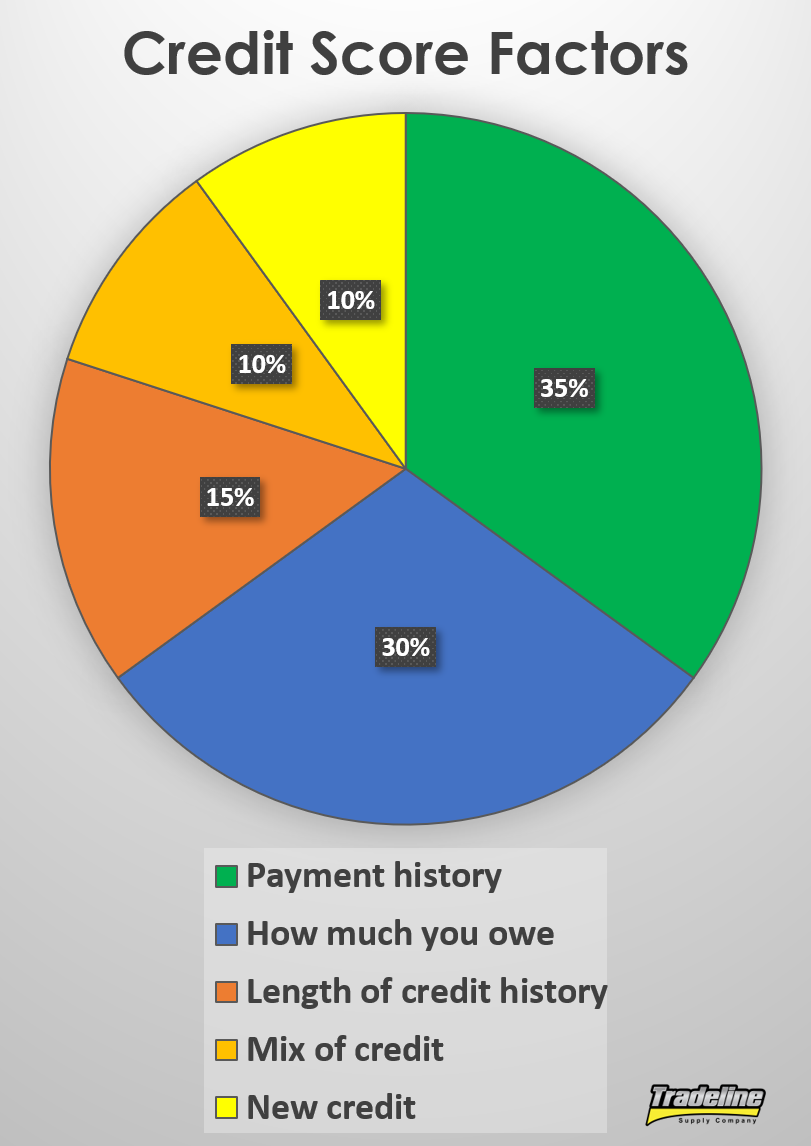

Payment history makes up 35% of your FICO score.

Are There Downsides to Getting a Credit-Builder Loan?

With a “fresh start” loan, as with any loan, it can hurt your credit score if you miss any payments. Remember, payment history is the biggest contributing factor to your credit score, weighing in at 35%. So when it comes to building credit, you need to be prepared to make every single payment on time.

In addition, you will be paying interest on the loan and potentially an application fee or other fees, although some lenders may partially refund the interest if you pay the loan back on time.

Finally, it may be several months to over a year before you finish paying off the loan and receive your borrowed funds. Building up a credit score by making payments on a loan takes a minimum of six months of payment history, according to FICO.

Other Ways to Build Credit

For those looking to build or rebuild credit, credit-builder loans are just one option. If you need to build credit fast, also consider one of the credit piggybacking methods we cover in “The Fastest Ways to Build Credit.”

By purchasing authorized user tradelines, for example, you can add seasoned tradelines with years of credit history to your credit report within just days.

Conclusions on Credit-Builder Loans

For those who may be struggling to build credit due to bad credit or lack of credit history, a credit-builder loan represents one way to get a loan with no credit check and start building a positive credit history.

Just like other types of loans, credit-builder loans come with interest and fees, and the main downside of this type of loan is that you don’t have access to the funds until after you have made all the payments.

On the other hand, when you finish paying off the loan, you will have built up a record of on-time payments and you will have a chunk of savings to take home.

Credit-builder loans can also make a great complement to other methods of building credit, such as credit piggybacking.

Read more: tradelinesupply.com