Tradelines in 5 Easy Steps

While the credit system is definitely complicated, buying tradelines doesn’t have to be. Just keep a few basic principles in mind and follow these five steps to make buying tradelines easy!

Here are the five easy steps that we’ll break down in this article:

Understand your credit profile

Determine your goals

Choose tradelines that fit your credit profile and align with your goals

Order your tradelines

Wait for your tradelines to post!

1. Understand your credit profile

Understanding your credit file is the foundation of improving your credit. If you don’t know what’s in your file and blindly move ahead with tradelines and/or credit repair, you could easily make a mistake that could hurt your credit more than it helps.

Your credit report shows a list of all of your tradelines, and how you manage these tradelines is reflected in your credit score.

We’ve written about everything you need to know about credit scores previously, but to summarize, these are the main factors that affect your credit score:

Payment history: 35%

Utilization (how much you owe): 30%

Length of credit history: 15%

Credit mix: 10%

New credit: 10%

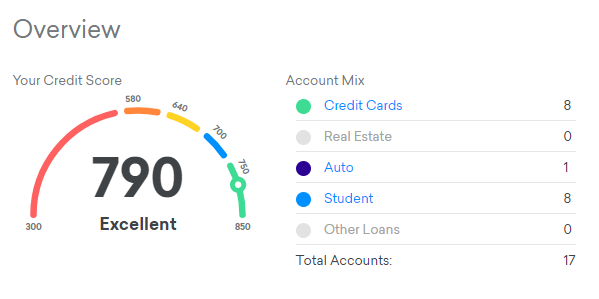

Before buying any tradelines, you’ll want to take a good look at your credit profile on CreditKarma.com (or order one of your three free credit reports allowed each year from annualcreditreport.com) and make sure everything is accurate and up to date.

You can get an overview of your credit profile for free on CreditKarma.com.

If there is inaccurate information in your credit profile, you may want to look into credit repair in addition to tradelines.

Examine each of your credit accounts and try to understand how it may be affecting your credit score, whether positively or negatively.

This foundational step will allow you to form a clear picture of your unique credit situation so you can choose the smartest path to move forward.

2. Determine your goals

Consider these five main factors that affect your credit score when setting your goals.

Now that you are aware of what is in your credit profile, ask yourself what variables could be improved and which strategies would be a good investment of your time, effort, and money.

For example, if you have a blemished payment history that is bringing down your score, you could balance that out by adding as much positive payment history as possible with a seasoned tradeline.

If your credit age is not old enough, you may want to increase the age of your oldest account and your average age of accounts by adding a tradeline with a lot of age.

Perhaps you have a thin file or your credit mix is unbalanced, and you just want to add more tradelines to your credit file.

These are just a few examples of common goals that people often have when they are looking to add tradelines to their credit report. Make sure your goals are personalized to your unique credit situation.

3. Choose tradelines that fit your credit profile and align with your goals

Choosing the correct tradeline tends to be the trickiest part of this process. However, there are really only two main variables that you need to consider when selecting tradelines: the age of the card and the credit limit.

The tricky part is that people often incorrectly assume that they should just get the highest credit limit. In reality, this approach could actually backfire and hurt your credit, because the age of the tradeline is much more important in the vast majority of cases.

However, the credit limit does still come into play if utilization is a factor you are concerned about.

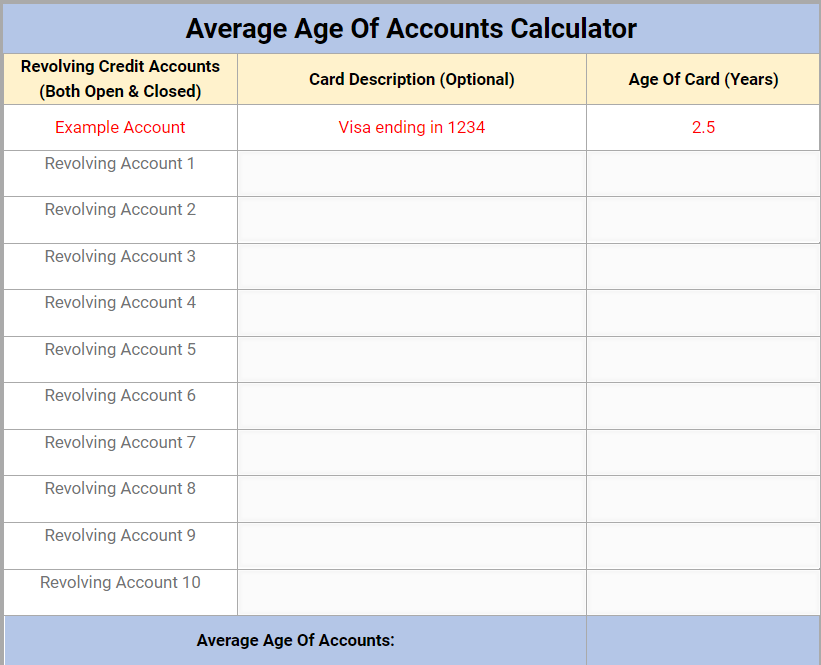

To account for both credit age and utilization, you’ll want to calculate your own average age of accounts and overall utilization ratio using our custom Tradeline Calculator. Simply input the numbers from your credit profile and the calculator will do the work for you.

Use our Tradeline Calculator to calculate your average age of accounts and utilization ratio.

Then, try plugging in information from some of the tradelines you are interested in purchasing and see how the numbers change. To get the maximum benefit from tradelines, you want to see the average age of accounts jump up at least to the next age level.

Based on our research, we estimate that the age levels to shoot for are 2 years, 5 years, 8 years, 10 years, and 20 years. So if your average age of accounts is 3 years, for example, it is probably a good idea to buy a tradeline that will boost that average to at least 5 years.

It’s important to fully think through your decision instead of just buying a tradeline that “seems” like a good choice.

For more guidance on choosing the best tradelines for your goals, we strongly encourage you to read “How to Choose a Tradeline” and “Common Mistakes Made When Buying Tradelines.”

4. Order your tradelines

Add tradelines to your cart and checkout on our secure site.

Once you have identified the best tradelines for you, simply add them to your cart and check out on our secure website!

To ensure that all goes smoothly with your purchase and that your tradelines post as guaranteed, you need to make sure you do not have any credit freezes or fraud alerts with any of the credit bureaus.

These actions block access to your credit report, so no new tradelines can be added. If you do have a credit freeze or fraud alert, contact each credit bureau to remove it before purchasing tradelines.

For detailed instructions on how to place a tradeline order, see “How to Purchase Tradelines and What to Expect.”

5. Wait for your tradelines to post!

The last step is the easiest of all: sit back and wait for your tradelines to post! Once you receive your confirmation email, simply wait until the last day of each tradeline’s reporting period and then check to verify that the tradelines have posted.

Then, celebrate your new tradelines on social media! Don’t forget to tag us @tradelinesupply and use #tradelinesupply so we can find your post!

Share this image on social media and tag us when your tradelines post!

The banks and credit bureaus sometimes have errors in their reporting, so, unfortunately, there is a small chance that a non-posting could occur. However, if a tradeline does not post to at least any two out of the three credit bureaus, we will provide a refund or exchange for that tradeline. Simply follow the instructions detailed in “Report a Non-Posting” to submit your refund request.

6. Extra credit: Become a tradeline expert using the resources in our Knowledge Center!

The more you learn about tradelines, the more informed you will be when it’s time to buy. Those who are educated on the credit system and how tradelines work are in the best position to maximize their results from tradelines.

Check out our extensive library of tradeline resources in our Knowledge Center to become a tradeline expert and a highly informed buyer.

Read more: tradelinesupply.com