How to Get an 850 Credit Score [Infographic]

People who are serious about improving their credit often wonder what it takes to get the highest possible credit score. For the FICO 8 credit scoring model, the perfect credit score is 850.

As of April 2019, only about 1.6% of scorable consumers in the United States have the elusive 850 credit score, which is actually an increase from 0.98% in April 2014 and 0.85% in April 2009.

There are many other credit scoring models that are used for different purposes and may have different credit scoring ranges. However, since FICO 8 is the most commonly used credit score, we will use the number 850 as the benchmark for the ideal credit score.

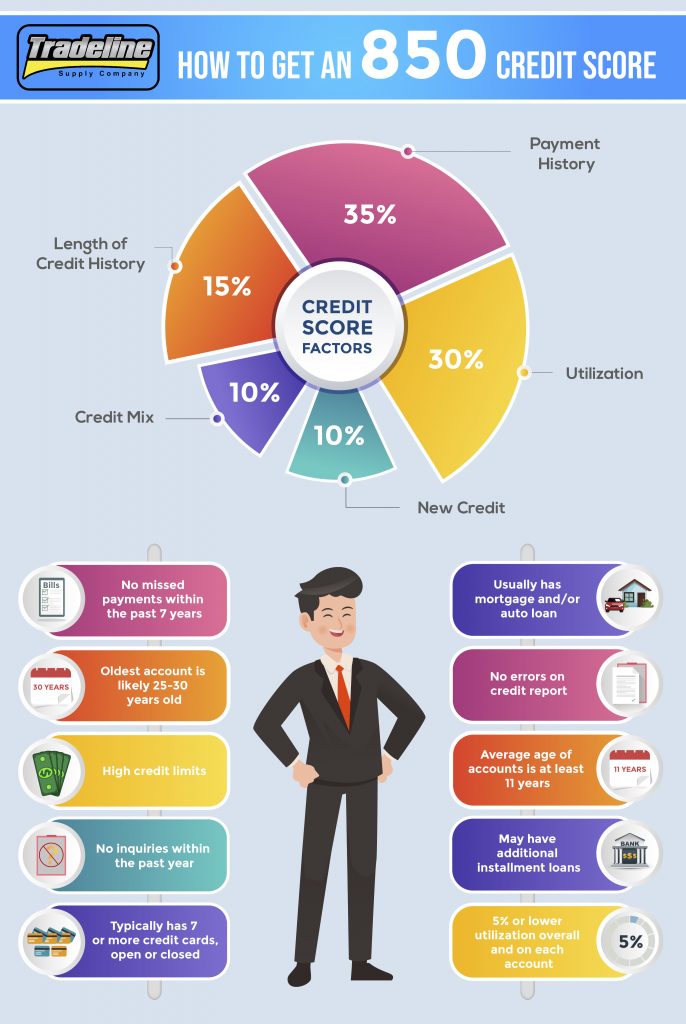

Check out the infographic below for some fast facts on how to get the highest credit score possible, then keep reading the article for even more tips on getting the coveted 850 credit score.

Payment History — 35%

Most people who have an 850 credit score have seven years of perfect payment history.

Your payment history is the biggest slice of the credit score pie, so even one late payment or missed payment can significantly affect your score. Negative items can stay on your credit report for up to seven years, so if you miss a payment, you may not be able to achieve a perfect 850 credit score until at least seven years have passed!

To safeguard against the possibility of forgetting to make a payment, consider setting up automatic bill pay for all of your accounts. Be sure to continue to check your accounts regularly in case of any system errors.

If you do miss a deadline once in a blue moon but have otherwise been an upstanding customer, try negotiating with your creditor to see if they will forgive the late payment and wipe it from your record.

FICO says that 96% of “high achievers,” or those with FICO scores above 785, have no missed payments on their credit report.

Essentially, to get an 850 credit score, you just need to follow one simple strategy: make all of your payments on time for a long time. We will further discuss the connection between payment history and time in the “Length of Credit History” section below.

Credit Utilization/How Much You Owe — 30%

The amount of debt you owe compared to your total credit limit is your credit utilization ratio. To get a perfect credit score, you’ll want to keep this ratio as low as possible, both overall and on each of your individual tradelines.

A study by VantageScore and MagnifyMoney found that people with the best credit scores and people with the worst credit scores actually had similar amounts of outstanding debt. However, those with the best scores had an average total credit limit of $46,700—16 times the credit limit of those with the worst scores!

Therefore, for the high scorers, that outstanding debt made up a much smaller percentage of their total available credit than those with low credit limits and poor scores, which highlights the importance of the overall utilization ratio.

This study reported that the average credit card user has an overall utilization ratio of 20%, which is generally considered to be a safe number for maintaining decent credit. To become someone who has an 850 credit score, however, you’ll need to keep it around 5% or lower. As of 2019, FICO says that the average revolving utilization for those with the “850 profile” is 4.1%.

While consumers with 850 credit scores do use credit cards, they tend to keep their utilization ratios around 5% or lower. Photo by Ellen Johnson.

In addition, keep in mind that even if you have a low overall utilization ratio, individual cards with high utilization could still bring down your score. You can read more about this in our article on individual vs. overall credit utilization ratios.

As a hypothetical example, let’s say you have two cards: one with a $10,000 limit and a $0 balance and the other with a $1,000 limit and a $900 balance. Your total available credit is $10,000 + $1,000 = $11,000 and your total debt is $900. Therefore, your overall utilization ratio is $900 / $11,000 = 8% utilization, which is a very good number.

However, your account with the $1,000 limit has a 90% individual utilization ratio! Since you only have two accounts, that means 50% of your accounts have high utilization, and that could negatively affect your credit. According to creditcards.com, maxing out just one credit card can reduce your score by as many as 45 points.

To get around this problem, if you have any individual cards with high utilization, consider transferring the balance to other accounts to keep the utilization ratio on each account as low as possible.

You could also request credit line increases from your creditors, which can lower your utilization ratios and benefit your score. Try using the tips we provide in “How to Increase Your Credit Limit.”

Another way to help with overall utilization is to add low-utilization tradelines to your credit file.

Optimizing this factor also means not closing old accounts even if you don’t use them very often, because their credit limits could be helping your score. To ensure old accounts don’t get automatically closed by the banks for inactivity, try to use them every 1-2 months, perhaps for small, recurring bills.

Length of Credit History (Age) — 15%

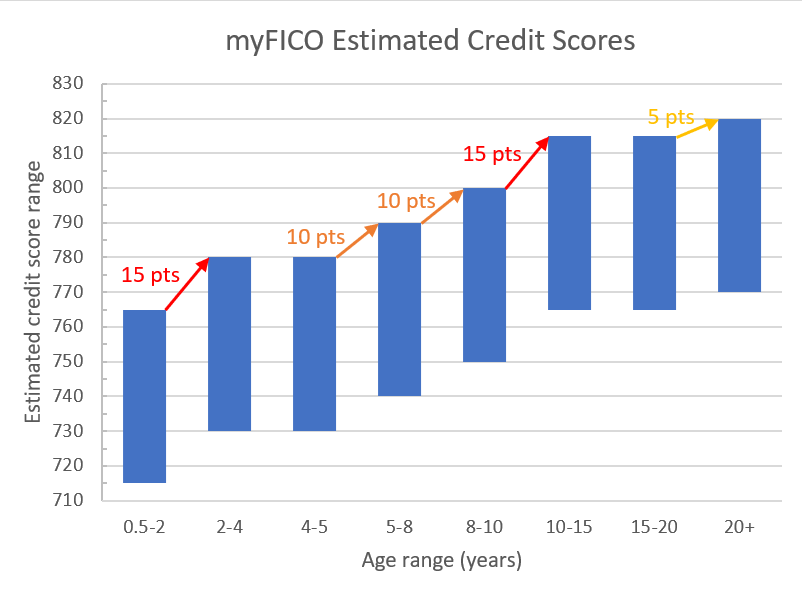

This category takes into account age-related factors such as the average age of your accounts, the age of your oldest account, and the ratio of seasoned to non-seasoned tradelines. (A seasoned tradeline is an account that is at least two years old, which is when the account is believed to have a more positive impact on your credit.)

The more age your accounts have, the more they will help your credit score.

Age goes hand-in-hand with payment history, because the more age an account has, the more time it has had to build up a positive or negative payment history. Together, age (15%) and payment history (35%) make up 50% of your credit score, which shows how important it is to open accounts early and make every single payment on time.

This is also why we always say that focusing on age is the #1 secret to unlocking the power of tradelines.

According to FICO, the age of the oldest account of people who have 650 credit scores is only 12 years, compared to 25 years for people who have credit scores above 800. In addition, individuals with fair credit have an average age of accounts of 7 years, compared to 11 years for those with excellent credit.

Cultivating an 850 credit score takes years of maintaining a positive credit history.

FICO reports that the average age of the oldest account of consumers who have 850 credit scores is 30 years old.

We have an in-depth discussion of which age tiers are most significant in our article, “Why Age Is the Most Valuable Factor of a Tradeline,” but the bottom line for getting the best credit score is simply to get as much age as possible. Seasoned tradelines can help by extending the age of the oldest account and the average age of accounts.

Also, keep in mind that it may be impossible to achieve an 850 credit score without a certain amount of age, even if you do everything else perfectly. So if you have stellar credit habits but haven’t yet been able to join the 850 credit club, you may just need to wait patiently for your accounts to age.

Credit Mix — 10%

While the mix of credit is one of the least important factors in a credit score, to get a perfect credit score of 850, you will still need to consider this factor.

In this category, credit scores reward having a balanced mix of several different accounts, including both revolving credit and installment loans. This is because creditors want to see that you can successfully manage a variety of different types of credit.

As an example, a credit file that includes an auto loan, a mortgage, and two credit cards has a better credit mix than a credit file that has four accounts that are all credit cards.

About the “credit mix” credit score factor, FICO says, “Having credit cards and installment loans with a good credit history will raise your FICO Scores. People with no credit cards tend to be viewed as a higher risk than people who have managed credit cards responsibly.”

The total number of accounts is also considered, with more accounts generally being better, up to a certain point.

FICO also states that high score achievers have an average of seven credit card accounts in their credit files, whether open or closed.

Auto loans are common among people who have 850 credit scores.

If you are looking to improve your credit mix statistics, adding authorized user tradelines can increase the total number of accounts and help diversify one’s credit file.

850 scorers also have installment loans in their credit files. According to Experian, the average mortgage debt for consumers with exceptional credit scores (800 or above) is $208,617. In addition, people who have FICO scores of 850 have an average auto-loan debt of $17,030.

Experian says, “In every other debt category except mortgage and personal loan, people with perfect scores had more open tradelines but less debt than their counterparts with average scores—underscoring the value of being able to manage debt while having numerous credit accounts.”

For a more detailed breakdown of the credit mix factor of your credit score, see our article, “Credit Mix: Do You Need to Care About Types of Credit?”

New Credit — 10%

The “new credit” category of your credit score refers to how frequently you shop for new credit. This includes opening up new credit cards and applying for loans, for example. This “new credit” activity is reflected in the number of inquiries on your credit report.

Since seeking new credit makes you look like a higher risk to creditors, each hard inquiry has the potential to drop your score by a few points. Therefore, if you are going for a perfect 850, it’s best to avoid applying for new credit for a while.

However, it is possible to score an 850 with hard inquiries on your record. FICO recently stated that around 10% of 850 scorers had one or more inquiries within the past year, and about 25% had opened at least one new credit account within the past year.

If you need to shop for an auto loan or mortgage, be sure to complete all your applications within a two-week window in order for all of the credit pulls to count as one inquiry. For credit cards, however, each inquiry will be typically be counted individually.

Fortunately, inquiries only remain on your credit report for two years, and FICO scores only consider inquiries that occurred within the past year, so it shouldn’t take long for your credit to recover if you do have new inquiries on your credit report.

Inquiries aren’t the only thing that matters when it comes to the new credit factor of your credit score, however. It also includes data points such as the number of new accounts you have, the ratio of new accounts vs. seasoned accounts, and the amount of time that has passed since opening new accounts. The main idea if you want to maximize your credit score is to not open too many new accounts at once, which can make you look riskier to lenders and bring down your score.

More Tips on How to Get an 850 Credit Score

In addition to optimizing each of the above five categories that factor into your credit score, it is also important to regularly check for errors on your credit report and dispute any inaccurate information both with the credit bureaus as well as with the lenders who furnish the data to the bureaus.

In addition, those with very high credit scores rarely have serious delinquencies or public records on their credit reports, such as bankruptcies or liens. Obviously, this will be easy to avoid if you follow all of the suggestions above, but if you have a history of bad credit in your past, it could take up to 7-10 years to recover enough to get an 850 credit score.

850 Credit Score Benefits

What are the benefits of being in the 850 credit club? In reality, you’ll be able to take advantage of the benefits of having an excellent credit score whether you have a 760 credit score or an 850 credit score. You don’t need to score a perfect 850 to get the best credit cards or the best interest rates on loans.

Essentially, the main benefit of having the best possible credit score is bragging rights!

Final Thoughts on How to Get the Perfect Credit Score

While it’s probably not necessary to get an 850 credit score, it is smart to work toward the goal of having excellent credit by managing your credit wisely, which will eventually get you into the upper levels of high credit score achievers.

The most important factors of your credit score are payment history, utilization, and age. Therefore, to keep your credit in pristine condition, you’ll need to make all of your payments on time, keep your utilization as low as possible, and maximize your credit age. Beyond that, you’ll also want to maintain a balanced mix of accounts and minimize new credit inquiries.

Finally, take advantage of your three annual free credit reports to make sure your credit reports are free of damaging errors.

To summarize, here’s an example of what the credit profile of someone who has an 850 credit score might look like, as we illustrated in the infographic above:

No missed payments or delinquencies within the past seven years

A high total credit limit

The overall utilization ratio is 5% or lower

Individual credit cards each have low utilization, around 5% or lower

The oldest account is likely about 25-30 years old

The average age of accounts is at least 11 years

Typically has at least seven credit card accounts (whether open or closed)

Usually has an auto loan and/or a mortgage loan

May have additional installment loans

Minimal inquiries within the past year

No damaging errors on their credit report

Have you ever achieved the perfect 850 credit score? Is it a goal that you are currently working toward? Share your thoughts with us by leaving a comment below!

Read more: tradelinesupply.com