Buying Tradelines: How Many Tradelines Do I Need?

When purchasing tradelines, there are some cases where it is best to get a single tradeline and other cases when multiple tradelines might be more appropriate. To help you decide, we’ve provided some examples for each scenario below.

When to Buy Two or More Tradelines

Thin Credit File (Too Few Accounts)

Balance out derogatory accounts with positive tradelines.

Credit scoring models value a mix of several different types of credit accounts, so a thin file with only a few accounts might be limited in what it can achieve. In this case, adding a few tradelines would be ideal because it would help increase the number of accounts in the file.

On the other hand, someone with no credit at all or an extremely thin file can also experience significant benefits from adding one tradeline, since they didn’t have much there to begin with. Of course, more than one tradeline will help even more.

Balancing Out Derogatory Accounts

Accounts that have negative marks such as late payments and collections can really drag down credit. Derogatory accounts need to be outweighed by positive accounts, so one’s credit report should contain at least 2-3 positive tradelines for every negative account. Therefore, multiple tradelines may be necessary to balance out derogatory accounts damaging one’s credit.

Maximizing Results

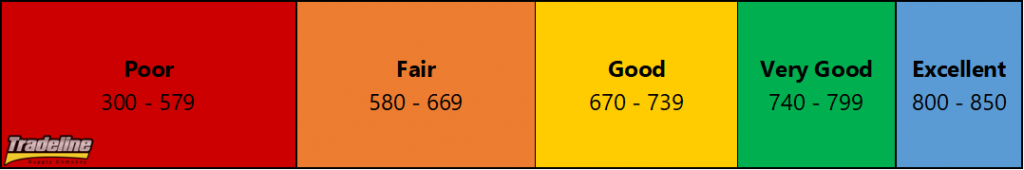

For those looking to get maximum results, buying several of our best tradelines would be the ideal plan. This becomes increasingly important for people who already have good credit (680 FICO or higher) because it is much more difficult to significantly impact one’s credit report with a file that is already relatively strong.

There is also a point of diminishing returns on tradelines for those with already high credit scores, so situations like this require purchasing the absolute best quality tradelines in order to achieve positive results.

In other instances, the goal may be extremely important and the risks of failing to meet that goal may be significant. In situations where the outcome is very important, we recommend using the maximum strength possible.

Of course, the risk is that there are no guarantees on what the results will be, but at least you can be sure that you received the maximum benefit possible from tradelines. The rest is up to you.

Posting to a Specific Credit Bureau

In time-critical situations, purchasing additional tradelines will help protect against potential non-postings.

If it is important for a tradeline to post to a specific credit bureau, this is a good time to consider purchasing more than one tradeline.

Unfortunately, banks and credit card companies are not always 100% accurate in their reporting process, so while we guarantee that each tradeline will post to at least any two out of the three major credit bureaus, we do not have any control over which of the three bureaus the tradelines will post to.

Because there is always a degree of uncertainty with tradelines, if you are looking to get a tradeline to post to a specific bureau, purchasing extra tradelines will help provide the added security you need.

Important Time-Sensitive Events

Similarly, if something important and time-sensitive is going on that depends on the tradelines posting, the safest bet is to get more than one tradeline. Again, we do offer a money-back guarantee in the event that a non-posting occurs, but the fact is that non-postings do occasionally happen due to inconsistent reporting by the banks.

In time-critical situations, there may not be time to exchange a non-posting tradeline for a new one and wait for the new one to post. If you are counting on tradelines to post within a certain time frame, investing in additional tradelines will help hedge against potential non-postings.

When to Buy One High-Quality Tradeline

It’s usually best to purchase one high-quality tradeline if there are budget constraints.

Budget Constraints

If your budget is constrained to a certain dollar amount, it is usually better to purchase one high-quality tradeline rather than dividing that amount between two tradelines that are not as high in quality.

This is because credit scores consider both your average age of accounts and the age of your oldest account. A single account with lots of age has more potential to increase those numbers, while two accounts with less age may not offer as much improvement or might even dilute the credit file.

Here is a hypothetical example to consider. Let’s say your current average age of accounts is 2 years. If you were to spend the same amount of money in either case, would it be better to buy two tradelines that are both 4 years old, or one tradeline that is 8 years old?

If you decided to buy the two 4-year-old tradelines, this would increase your average age of accounts to about 3 years ([2 + 4 + 4] / 3 = 3.3) and your oldest account would be 4 years old.

On the other hand, if you were to buy one 8-year-old tradeline, this would bump up your average age of accounts to 5 years ([2 + 8] / 2 = 5) and your oldest account would be 8 years old.

In the second scenario, you end up with a higher age for both of these important credit history factors. Be sure to check out our tradeline buyer’s guide and tradeline calculator to help determine the best plan of action for your situation.

Current credit file

After adding 2 4-year-old tradelines

After adding 1 8-year-old tradeline

Average age of accounts

2 years

3 years

5 years

Age of oldest account

2 years

4 years

8 years

It is more difficult to affect the average age of accounts when there are many accounts, so one high-quality tradeline tends to be the best choice for very thick files.

Extending the Age of Your Oldest Tradeline

The age of the oldest account in your credit file is a very important data point. If the goal is simply to extend the age of the oldest tradeline in the credit report, then of course only one tradeline is needed. The tradeline just needs to be older than the oldest account that is currently on file, but obviously, the more age the better, so we recommend going significantly older.

Very Thick File (15 or More Accounts)

A very thick file with a large number of accounts will “dilute” the power of any tradelines that are added. Since there are so many tradelines already in the file, it will be more difficult to affect the average age of accounts. Therefore, one premium tradeline with a lot of age and a high credit limit will be a better fit for a very thick file, rather than multiple less potent tradelines.

Focusing on Credit Limit

Some consumers are less concerned with the age of the tradelines and more concerned with the credit limit for their specific circumstances. If a high credit limit is the main priority, it will usually make more sense to purchase one tradeline with a high credit limit rather than multiple tradelines that have lower credit limits.

If a high credit limit is the goal, usually one tradeline is enough.

The strategy on this topic may vary depending on what you are trying to accomplish and what your goals are, but in general, if you can accomplish the goal with one tradeline, that would probably be the better option.

Modest Goals

Depending on what a person’s goals are, they may not need to get the maximum results possible. For smaller goals, one tradeline may be all they need. However, it is always best to try to overshoot the goal in order to have some extra insurance in making sure the goal is truly achieved.

No Credit File or an Extremely Thin File

As we mentioned previously, adding a few tradelines to a thin credit file is ideal because it greatly increases the number of accounts in the file.

Adding just one tradeline to a very thin credit file can make a big difference.

However, it’s also important to keep in mind that someone with no prior credit history or an extremely thin file may still find value in buying just one tradeline, since adding one account to a baseline of zero or one existing accounts is still a significant change.

As an example, adding one tradeline to a credit report that previously only had one account in it represents a 100% increase in the number of accounts in the file! This not only adds valuable age and payment history but also impacts the “credit mix” factor in credit scoring.

Key Takeaways on How Many Tradelines to Buy

To summarize when you should consider purchasing a single tradeline versus when you should consider investing in more than one tradeline, we have included the main points of this article in the table below.

When to Buy Two or More Tradelines

When to Buy One High-Quality Tradeline

If you have a thin credit file (too few accounts)

If you have budget constraints

If you need to balance out derogatory accounts

When you want to increase the age of your oldest tradeline

When you want to maximize results

If you already have a very thick file (15 or more accounts)

When you need a tradeline to post to a specific credit bureau

If you want a high credit limit

If you need a tradeline for an important, time-sensitive event

If you have modest goals

If you have no credit file or an extremely thin credit file

If you are wondering how many tradelines you need, remember that the power of tradelines is always going to be relative to your current credit file and it is important to consider what will be the best fit for your specific situation.

In some situations, it may be important to maximize results using multiple powerful tradelines, such as when you are trying to accomplish a major goal or when there are serious hurdles to overcome. In other cases, one good tradeline might be all you need.

Whatever the case may be for you, it is always best to understand how tradelines work first and foremost and avoid making any common mistakes.

In simplest terms, the safest option is always to overshoot your goal and stick with the highest quality tradelines within your budget, and remember that in most cases, age is key. If budget is a big concern, then it’s usually best to just buy one of the highest quality tradelines your budget allows.

What are your thoughts on this article about how many tradelines to buy? We would love to hear your feedback, so leave a comment below!

Read more: tradelinesupply.com