7 Surprising Things That Won’t Affect Your Credit Score

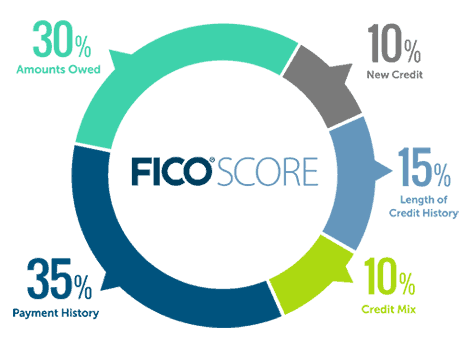

Paying your bills on time, not maxing out your credit cards, and having a good track record of managing debt responsibly are some basic and obvious things that affect a credit score.

Some other financial transactions, however, don’t hurt it at all. You may even be surprised by them.

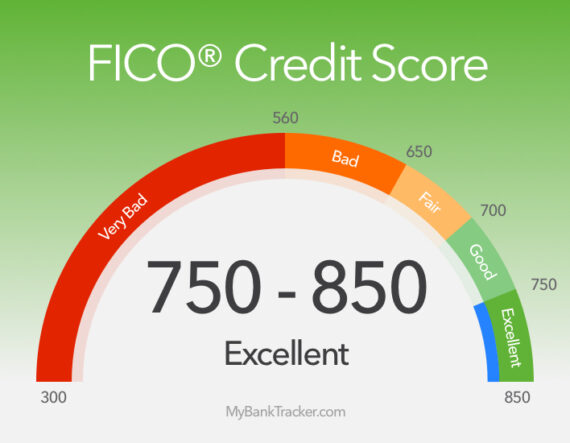

Here are seven things that don’t affect a credit score, which is a score worth improving so you’ll have access to the best loan rates and terms:

Income

Creditors and lenders obviously want you to have an income, and information about your employer may be listed on your credit report, but your actual income isn’t reported as part of a credit score.

Your income will be used to decide how much you can afford to borrow, but a high salary won’t boost your credit score and a low salary won’t hurt it. How you manage your bills is what you should be concentrating on to improve your credit score.

Overdrafts

Overdrawing your bank accounts can be costly, but they won’t hurt your credit score — as long as you clear them before they go to collections.

If your checking account remains overdrawn for weeks and the bank sends it to a collection agency, then expect your credit score to be dinged. It’s not the overdraft account that’s causing the credit score to drop, but the fact that it went to a debt collection agency.

What’s more likely to happen is with your information ending up in ChexSystems, a consumer reporting agency that collects information on closed checking and savings accounts. If you overdraw your bank accounts often, you could be flagged as a problem and have difficulty opening new accounts or writing checks.

Missed insurance payments

A credit score can be used by an insurance company to calculate your insurance premium. But your insurer won’t report your insurance premium payments — whether on time or late — to credit bureaus.

If you miss just one insurance payment, your insurance company could cancel the policy entirely or until payment is made. But it’s unlikely to send it to a collection agency.

Checking your own credit

You can check your credit report or score as much as you want without being penalized for it. Start at AnnualCreditReport.com for a free report each year from three of the major credit reporting agencies.

If a lender checks your credit score, that will likely hurt a credit score, though only a little and not for long. That’s known as a “hard inquiry” that can drop a score by five points and can stay on your credit report for two years. Too many queries in a short time could drop it a little more. New credit determines 10 percent of a FICO credit score.

Checking your own credit is known as a “soft inquiry” and has no impact on your score. Why would you want to check it? To catch errors or potential fraud before applying for a loan.

Credit counseling

If you’ve sought help from a credit counselor to help manage your credit card payments, it may show up on your credit report. It won’t, however, hurt your credit score. If you’re put on a repayment plan, that could be part of your credit report but it won’t change your score.

As long as your creditor is getting your payments on time — either through you or the credit counselor — then the fact that you’re getting credit counseling won’t hurt your score. But if the payments arrive late, then expect to see your credit score drop.

Marriage

If your partner has a low credit score, it won’t affect yours when you marry them. Credit histories aren’t merged at marriage. Each person retains their own credit score, and having joint accounts together won’t affect that.

A joint account will, however, affect each person’s credit profile on their own credit score. If the wife doesn’t pay the credit card bill on time that the couple uses together, it will hurt both of their scores. The same goes for buying a house together or filing taxes jointly and any problems in those areas.

Bank account balances

Credit scores are a reflection of how you manage debt. Checking, savings and other such bank accounts that are assets aren’t factored into a credit score.

Liabilities such as credit card balances are considered. Only your creditors actively report to the credit bureaus.

Having a rotating balance on a credit card can hurt a score, especially if you use too much of the credit available to you. The higher your credit utilization ratio — your credit card balance divided by your credit limit — the more it can drop a credit score. Keeping it below 30 percent is best.

The post 7 Surprising Things That Won’t Affect Your Credit Score appeared first on Better Credit Blog | Credit Help For Bad Credit.

Read more: bettercreditblog.org