What Is the Difference Between Individual and Overall Credit Utilization Ratios?

What is the difference between your overall credit utilization ratio and individual utilization ratios and why does it matter to your credit? Keep reading to find out.

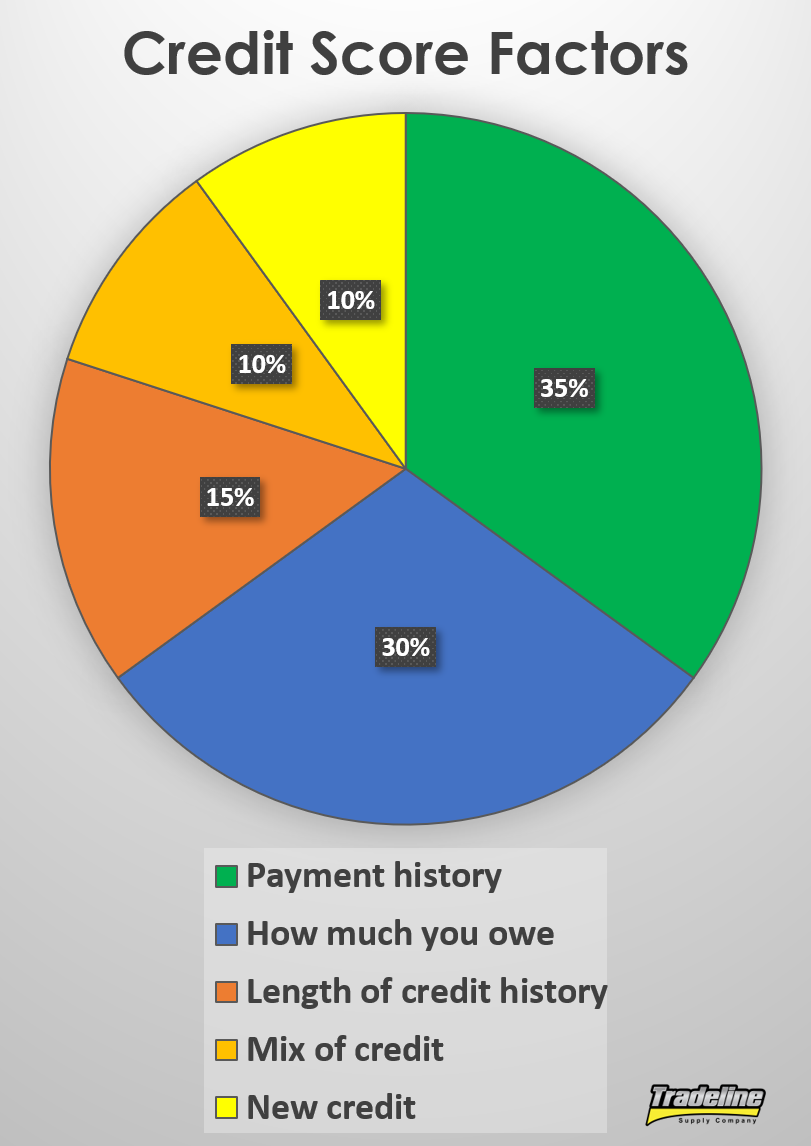

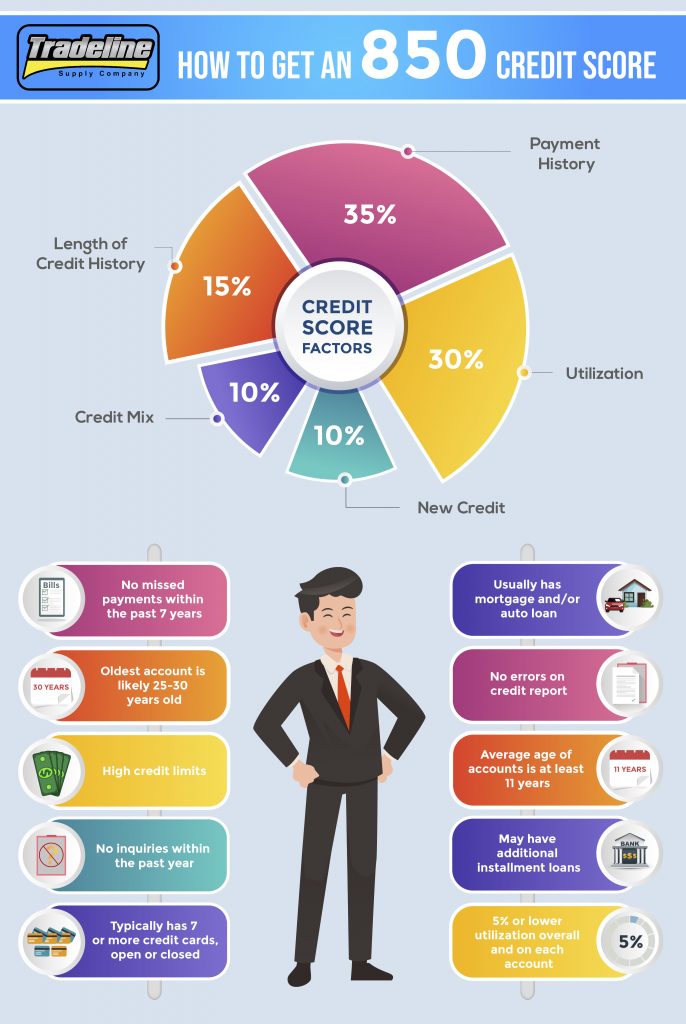

Credit utilization makes up 30% of a FICO score.

What Is Credit Utilization?

To put it simply, credit utilization is the amount of debt you owe compared to the amount of your available credit. In other words, it is the amount of your available credit that you are actually using.

In terms of your credit score, credit utilization makes up 30% of your score, second only to payment history.

The reason credit utilization is such an important part of your credit score is that the ratio of debt someone has is highly indicative of whether they will default on a debt in the future. The more you owe, the harder it becomes to pay off all that debt on time every month, which makes you a riskier bet for lenders.

Components of Credit Utilization

According to FICO, there are several components that fall within the category of credit utilization, such as:

The total amount you owe on all accounts (overall utilization)

The amount you owe on different types of accounts

The utilization ratios of each of your revolving credit accounts (individual utilization)

The number or ratio of your accounts that have balances

The amount of debt you still owe on your installment loans (e.g. mortgages, auto loans, student loans)

What Is the Difference Between Individual and Overall Utilization?

Your overall utilization ratio is the amount of revolving debt you have divided by your total available revolving credit.

For example, if you have one credit card with a $450 balance and a $500 limit and a second credit card with a $550 balance and a $3,500 limit, your overall utilization ratio would be 25% ($1,000 owed divided by $4,000 available credit).

However, the individual utilization ratios of your respective credit cards are 90% ($450 balance / $500 credit limit) and 16% ($550 balance / $3,500 credit limit).

Since credit scores consider individual utilization ratios, not just overall utilization, having any single revolving account at 90% utilization is going to weigh negatively on the credit utilization portion of your score.

Overall Utilization May Not Be as Important as You Think

Typically, when people think of the effect that credit utilization has on credit scores, they often assume that overall utilization is the only important variable.

By this assumption, it would be fine to have individual accounts that are maxed out as long as the overall utilization is still low.

Individual utilization ratios may be more important than the overall utilization ratio.

However, we have seen that this is often not true.

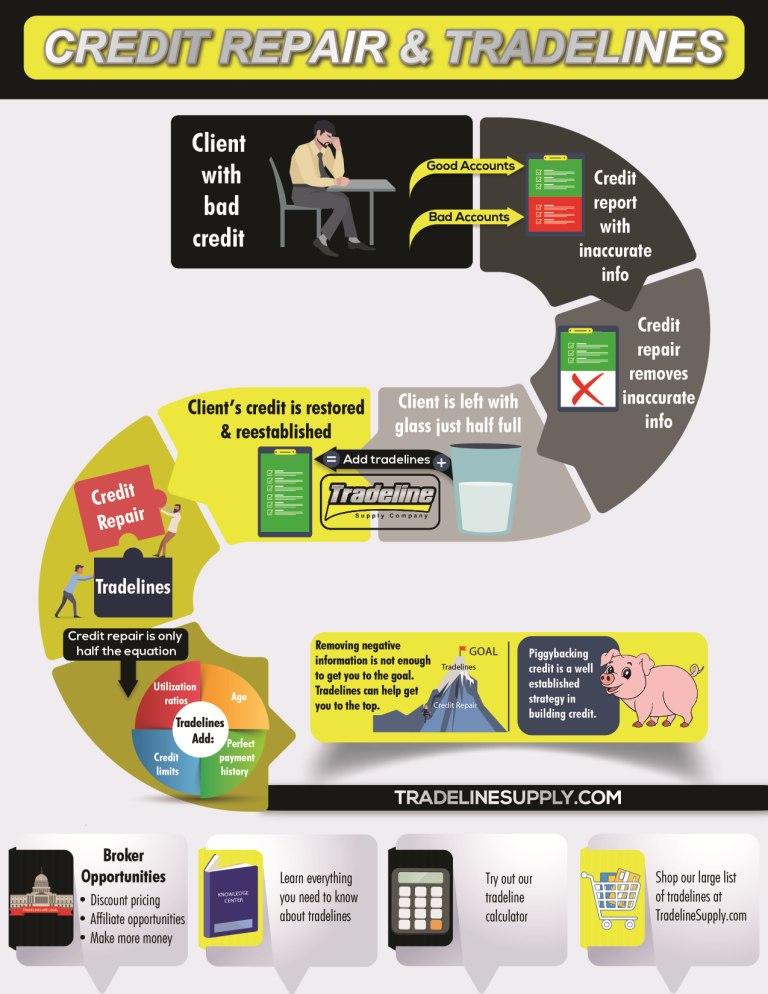

For example, sometimes clients with maxed-out credit cards will buy high-limit tradelines in order to reduce their overall utilization ratio, but then they don’t see the results they were hoping for.

This means that the individual accounts with high utilization are still weighing heavily on the clients’ credit scores, despite the fact that they have improved their overall utilization. In other words, the decrease in the overall utilization ratio did not make much of a difference.

Cases like this seem to indicate that overall utilization may not play as big a role as traditional wisdom has led us to believe and that the individual utilization ratios may be more important.

This is one of the reasons why we typically suggest that consumers focus on the age of a tradeline rather than the credit limit. Although people tend to gravitate toward high-limit tradelines, the age of a tradeline is actually more powerful in most cases, especially considering that lowering one’s overall utilization ratio may not help very much.

How Do Tradelines Affect Credit Utilization?

Although the age of a tradeline is often its most valuable asset, tradelines can still help with some of the credit utilization variables.

Since our tradelines are guaranteed to have utilization ratios that are at or below 15%, this means that at least 85% of that tradeline’s credit limit is going toward your available credit, which helps to lower your overall utilization ratio. In fact, most of our tradelines tend to maintain utilization ratios that are much lower than 15%.

Buying tradelines also allows you to add accounts with low individual utilization to your credit file, which can help to improve the number of accounts that are low-utilization vs. high-utilization.

Before buying tradelines, see where you stand currently by using our credit utilization ratio calculator. You can also use the credit utilization ratio calculator to see how your overall utilization ratio could be affected by adding new tradelines.

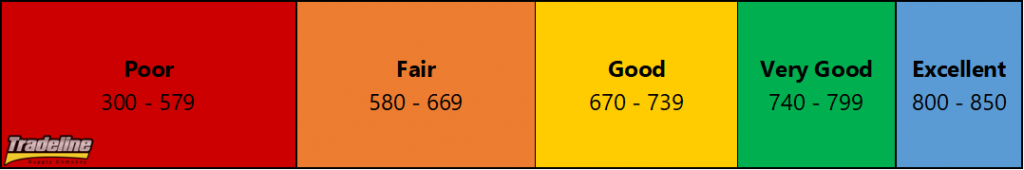

What Is the Ideal Utilization Ratio?

As a general rule of thumb, simply aim to keep your utilization as low as possible. However, you might be surprised to learn that having a zero balance on all revolving accounts is actually not the best scenario for your score.

According to creditcards.com, “…the ideal scenario tends to be having all but one card show a zero balance (zero percent utilization) and having one card with utilization in the 1-3 percent range.”

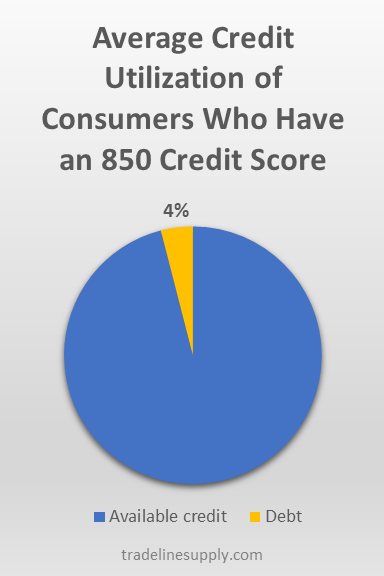

The average credit utilization ratio of consumers who have an 850 FICO score is about 4%.

Why? As it turns out, consumers with a 0 percent utilization ratio actually have a slightly higher risk of defaulting than those with low (but more than 0) utilization. A 0 percent utilization indicates that a consumer may not use credit regularly, which leads to the consumer having a higher risk of default in the future.

However, your utilization doesn’t necessarily have to fall in line with the above scenario in order to have a perfect credit score. In “How to Get an 850 Credit Score,” we found that consumers with FICO credit scores of 850 have an average utilization rate of 4.1%.

For those of us who use credit regularly, however, maintaining a minuscule balance may not always be practical. So what is a realistic threshold to shoot for?

While you may hear the figure 30% cited frequently, many credit experts say this is a myth and that you should aim for 20%-25% instead.

Tips to Avoid Excessive Revolving Debt Utilization

Spread out your charges between different cards

Since we have seen that it’s important to keep individual utilization ratios low, one strategy to accomplish this is to make your purchases on a few different credit cards instead of charging everything to one card. Spreading out your charges helps to prevent an excessively high balance from accumulating on any one individual card.

Pay off your balances more frequently

If you spend a lot on one of your cards, consider spreading out your charges between different cards or paying down the balance more often.

If you do spend a lot on one card, it helps to pay off your balance more than once a month. If your card reports to the credit bureaus before you have paid off your balance, it will show a higher utilization than if you had paid some or all of the balance down already.

You can either time your payment to post just before the reporting date of your card or you can make payments several times per month. Some people even prefer to pay off each charge immediately so their card never shows a significant balance.

Set up balance alerts to monitor your spending

To prevent mindless spending from getting out of control, try setting up balance alerts on your credit card. Your bank will automatically notify you when the balance exceeds an amount of your choosing, so you can back off of spending on that card or pay down your balance.

Don’t close old accounts

Even if you don’t use some of your old credit cards anymore, it’s often a good idea to keep the accounts open so they can continue to play a positive role in your overall utilization ratio and the number of accounts that have low utilization vs. high utilization.

Ask for credit limit increases

Another way to decrease your utilization ratios is to call your credit card issuers and ask them to increase your credit limit. By increasing your amount of available credit, you decrease your utilization ratio, both on individual cards and overall.

Keep in mind that your bank may do a hard pull on your credit to decide whether or not to grant your request, which could ding your score a few points temporarily. However, the small negative impact of the credit inquiry could be offset by the benefit of the credit line increase.

Also, this might not be an ideal strategy if you think you will be tempted to spend the new credit available to you, which could leave you even worse off than you started.

If you want to learn more about how you can successfully ask for credit line increases, check out our article, “How to Increase Your Credit Limit.”

Open a new credit card

Like asking for a higher credit limit, opening a new credit card can also lower your credit utilization, provided you leave most of the credit available.

Again, this will add an inquiry to your credit report, as well as decrease your average age of accounts, so this could have a negative impact on your score temporarily, which may be outweighed by the decrease in your credit utilization.

Transfer your credit card balances to different cards

A balance transfer is when you use available credit from one credit card account to pay off the balance on another credit card, thus “transferring” your debt balance from one card to another.

There are two ways to do this: you can transfer a balance to another credit card you already have, as long as it has enough available credit, or you can transfer a balance by applying for a new credit card and letting the card issuer know in your application which account you want to transfer a balance from and how much you want to transfer.

The latter option is best for your credit utilization, since opening a new credit card means you are adding available credit to your credit profile. In addition, it gives you the opportunity to apply for specific balance transfer credit cards, which usually come with low promotional interest rates on the balances you transfer.

However, using an existing account to do a balance transfer can still be beneficial if done properly, because it can help your individual utilization ratios. Just make sure the account you are transferring the balance to has a higher credit limit than the account that is currently carrying the balance in order to keep the individual utilization ratios as low as possible on each account.

Pay down smaller balances to zero

Having too many accounts with balances can bring down your score since credit scores consider the number of accounts in your credit file that are carrying a balance. If you have any accounts with smaller balances, paying those down to zero will decrease the individual utilization ratios on those accounts, reduce your overall utilization ratio, and reduce the number of accounts with balances, thus improving your credit profile in multiple ways.

Read more: tradelinesupply.com

Many people are uncertain about what may happen to their credit when they get married and what can happen to their credit if they get divorced.

Many people are uncertain about what may happen to their credit when they get married and what can happen to their credit if they get divorced.

If you’ve been paying attention to the world of credit, you’ve probably heard a lot about credit freezes lately. A credit freeze can be a valuable tool for those who may be concerned about identity theft. However, many people are unaware of how credit freezes works and how to use them.

If you’ve been paying attention to the world of credit, you’ve probably heard a lot about credit freezes lately. A credit freeze can be a valuable tool for those who may be concerned about identity theft. However, many people are unaware of how credit freezes works and how to use them.

When consumers ask me questions about their credit reports it’s normally about

When consumers ask me questions about their credit reports it’s normally about

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast.

Bruce McClary is the Vice President of Communications for the National Foundation for Credit Counseling® (NFCC®). Based in Washington, D.C., he provides marketing and media relations support for the NFCC and its member agencies serving all 50 states and Puerto Rico. Bruce is considered a subject matter expert and interfaces with the national media, serving as a primary representative for the organization. He has been a featured financial expert for the nation’s top news outlets, including USA Today, MSNBC, NBC News, The New York Times, the Wall Street Journal, CNN, MarketWatch, Fox Business, and hundreds of local media outlets from coast to coast. Derogatory items on your credit report can be a big problem for your finances. These negative marks can stay on your

Derogatory items on your credit report can be a big problem for your finances. These negative marks can stay on your