VantageScore vs. FICO Score: What’s the Difference?

If you monitor your credit using a free website, chances are, you’ve seen your VantageScore. However, you may not realize that this credit score is not your FICO score.

So what is a VantageScore credit score and how is it different from a FICO credit score? Is one better than the other? We’ll compare and contrast the two types of credit scores and discuss the merits of each in this article.

What Is a Vantage Credit Score?

The VantageScore credit score, sometimes referred to as a “Vantage credit score,” is a credit scoring model created in 2006 by the three major credit bureaus (Experian, TransUnion , and Equifax) to compete with FICO’s credit scoring models.

VantageScore is a tri-bureau credit score, meaning the exact same model is used at each credit bureau.

The most commonly used version of the VantageScore used by lenders today is the third iteration of the credit scoring model, VantageScore 3.0.

VantageScore Solutions, LLC has released VantageScore 4.0, which is supposed to be more accurate than previous versions, but since it takes lenders a long time to adopt new credit scoring models, most are still using VantageScore 3.0.

Who Uses VantageScore?

According to Experian, VantageScore is used by lenders for all types of loans except mortgages, where FICO is still the dominant player. The largest group of financial institutions that uses VantageScore is credit card issuers.

Non-financial institutions have also increasingly been adopting VantageScore, such as landlords and utility providers.

VantageScore is also widely used by consumer websites that provide educational credit scores and market credit products.

What Is My Vantage Score?

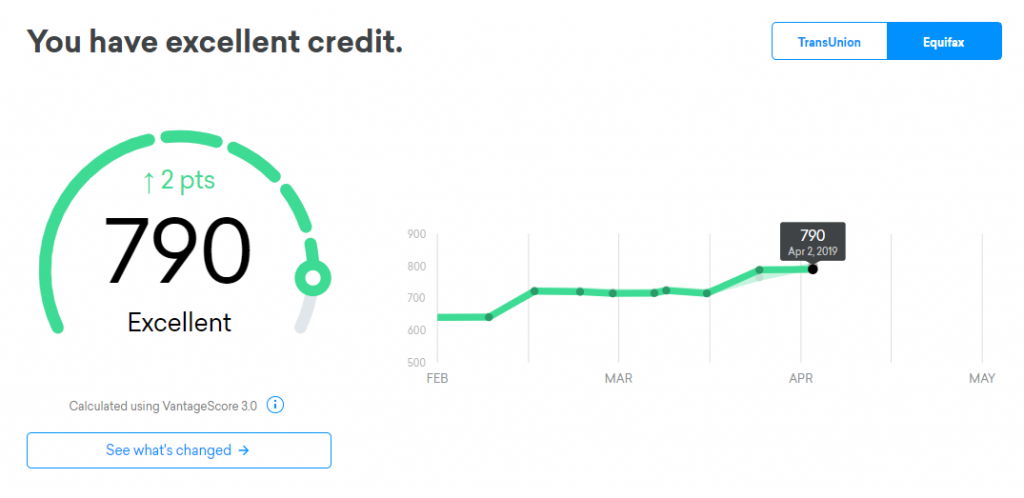

It’s easy to find out what your VantageScore is for free. Credit Karma provides free VantageScore 3.0 credit scores from TransUnion and Equifax, so all you have to do is create an account on creditkarma.com and log in to your Credit Karma account to see your free Vantage credit score.

Credit Sesame and NerdWallet are other sites that provide consumers with free VantageScore 3.0 credit scores from TransUnion.

You can view your free VantageScore with TransUnion and Equifax on Credit Karma.

VantageScore vs. FICO Score

The primary difference between VantageScore and FICO scores is what they are used for.

FICO scores have been in use for a longer period of time and, consequently, are most widely used by lenders to make lending decisions. According to U.S. News, FICO scores are used by 90 percent of “top lenders.”

While VantageScore credit scores are also used by some lenders, they are more well-known for their use as an educational tool.

Both FICO and VantageScore consider the same general categories of information from your credit report (although they use slightly different terms to describe them), which include:

Payment history

Utilization

Length of credit history/age

Mix of accounts/types of credit

New credit activity/recent credit

Since the scores share the same general categories, it is safe to assume that they will both be bolstered by the same common sense behaviors that lead to good credit, such as not using too much of your available credit and not missing payments.

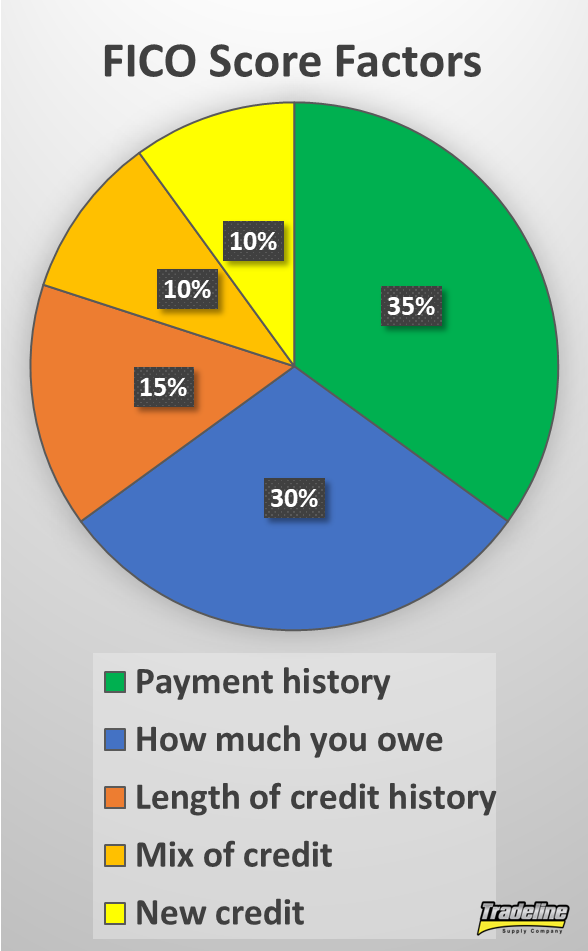

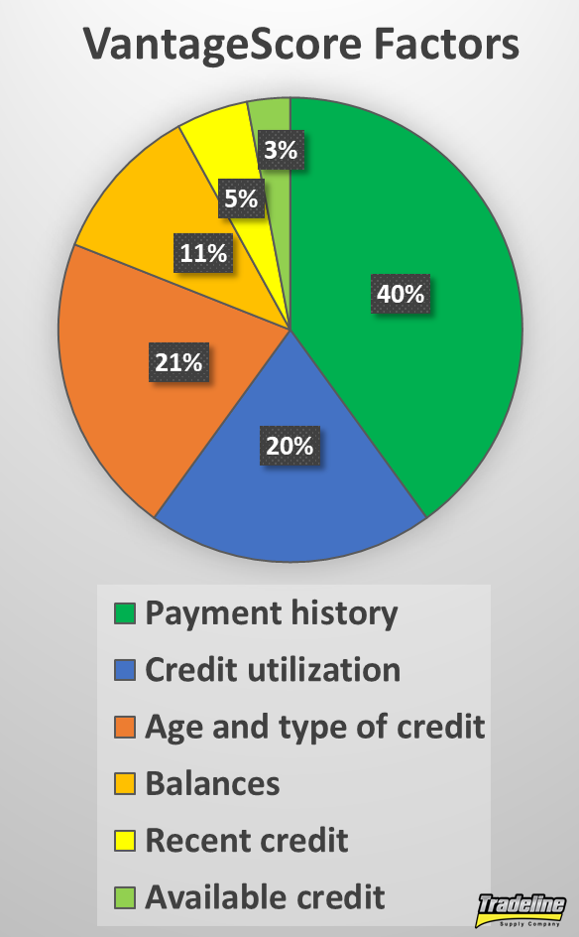

However, FICO and VantageScore assign slightly different weights to each category, as shown in the following table (percentage values are approximate).

FICO Score Factors

VantageScore Factors

Payment history, 35%

Payment history, 40%

Utilization, 30%

Credit utilization, 20%

Length of credit history, 15%

Age and type of credit, 21%

Mix of accounts, 10%

Balances, 11%

New credit activity, 10%

Recent credit, 5%

Available credit, 3%

FICO Score Factors

VantageScore Factors

In addition, within these broader categories listed above, the scoring models have different ways of assigning value to certain variables. Here are a few examples.

Inquiries

Hard inquiries can generally hurt your score by a few points because seeking new credit is considered risky behavior. When people are applying for some types of loans, such as mortgages, auto loans, and student loans, they tend to apply for multiple loans so they can shop for the best rates. Credit scoring models now have different ways of accounting for this behavior so as not to punish consumers for shopping around.

Newer FICO scores group inquiries of the same type together within a 45-day window. That means consumers could apply for 5 auto loans within 45 days and it would only count as one inquiry. Older FICO scores do this within a 14-day window.

FICO scores only apply this rule to student loans, mortgages, and auto loans—not credit cards. According to creditcards.com, the FICO scoring model also includes a 30-day “buffer” against hard inquiries, which means it ignores any inquiries that occurred within the last 30 days.

In contrast, VantageScore groups all inquiries within a 14-day window, regardless of the type of account. You could apply for some credit cards, a student loan, a mortgage, and an auto loan within 14 days, and it would only count as one inquiry.

Collections

Unpaid collections are always going to make a significant dent in one’s credit score, but paid collections and collections with small balances are treated differently between FICO and VantageScore.

With FICO 8, the credit score most widely used by lenders today, all unpaid and paid collections are damaging, regardless of the type of account. FICO 9, the newest FICO score, leaves out paid collection accounts and reduces the impact of unpaid medical collections specifically. Both FICO 8 and FICO 9 disregard collections when the original balance was less than $100.

VantageScore 3.0 and 4.0 are similar to FICO 9 in that they don’t count paid collection accounts and assign less importance to medical collections, but they do not make exceptions for collections with low balances.

Utilization

While utilization is treated fairly similarly with both scoring models, the specific thresholds that affect credit scores vary. VantageScore recommends keeping your credit utilization below 30%, while many experts believe that FICO scores suffer at lower utilization ratios.

Interestingly, the newer VantageScore 4.0 looks at the trends in your utilization over time, such as whether your balances have increased or decreased. FICO scores and previous VantageScore versions only look at the data that is in your credit report at the moment when your score is calculated and do not look “back in time.”

Other Differences Between VantageScore vs. FICO

Tri-bureau vs. single-bureau

With FICO, each credit bureau uses a different version of the score that is specific to that bureau. As a result, consumers often have different credit scores for each credit bureau.

VantageScore, however, was designed to work the same for all three credit bureaus in an effort to reduce the disparity in scores between credit bureaus.

Who can be scored

The two types of scoring models have different requirements for who can be scored.

FICO requires at least six months of credit history and at least one account reported within the last six months. That means if you’re just starting out in building credit, you’ll need to wait six months after opening your first account to establish a FICO score.

On the other hand, VantageScore is able to score consumers with only one month of credit history on at least one account reported within the last 24 months.

Credit score scale

Previous versions of VantageScore had a scale that was different from the scale that the FICO score uses. For example, VantageScore 2.0 ranged from 501-990. The VantageScore 3.0 range was changed to match the FICO credit score scale of 300-850.

However, they have slightly different rating scales within those credit score ranges, as you can see in the table below.

FICO Score

VantageScore 3.0

Credit Score

Rating

Credit Score

Rating

300-579

Very Poor

300-499

Very Poor

580-669

Fair

500-600

Poor

670-739

Good

601-660

Fair

740-799

Very Good

661-780

Good

800-850

Exceptional

781-850

Excellent

What Is a Good Vantage Score?

From the table above, we can see that a good VantageScore is between 661 and 780. Compare this to FICO’s good credit score rating, which is a narrower range of scores from 670 to 739.

720 would be considered a good credit score with both FICO and VantageScore. Photo by CafeCredit.com, CC 2.0.

Similarly, an excellent VantageScore credit score ranges from 781 to 850, while FICO’s “exceptional” credit rating ranges from 800 to 850.

Is There a VantageScore to FICO Conversion Formula?

Unfortunately, there is no Vantage to FICO conversion formula that can be used to calculate your FICO score from your VantageScore and vice versa.

As we learned in our comparison of VantageScore vs. FICO scores, the two scoring models assign different values to each credit score category and even have slightly different categories.

They also use different proprietary algorithms, the details of which are carefully guarded trade secrets.

To make things even more complicated, both FICO and VantageScore utilize “scorecards” or “buckets” to categorize consumers. Each scorecard has a different way of scoring consumers. In other words, the specifics of the credit score algorithms vary for different consumers even within the same version of a credit score.

Since each credit score is so complex and we as consumers do not have access to the secret algorithms, there is no reliable or accurate way of converting between the two.

Why Is My Vantage Score Lower Than FICO?

Since VantageScore and FICO scores differ in the weights they assign to each category and variable within the scoring model, it is likely that one will usually be lower than the other.

Since payment history is weighted more heavily with VantageScore than FICO (40% vs. 35%, respectively), a missed payment could bring your VantageScore down a bit more than your FICO score.

Another reason for having a lower VantageScore could be having unpaid low-balance collections on your credit report, which hurt your VantageScore but not your FICO 8 or 9 score.

However, what people tend to see more commonly is that their VantageScore is slightly higher than their FICO score because VantageScore seems to be more forgiving when it comes to credit utilization.

Which Credit Score Is Better?

Unfortunately, there is no straightforward answer to the question of which credit score is superior to the other. Each credit score has value for its respective purposes.

Although some people dismiss VantageScore as being a “fake” or inaccurate version of a FICO score, that’s not necessarily a fair comparison. Although both scores emphasize the same general credit principles, they have significant differences in the ways they treat certain factors. VantageScore is intended to be a competitor to FICO, not an exact replicate, so we shouldn’t expect them to be the same.

Since the same general principles shape how both scores work, however, oftentimes what helps one will help the other. This is why VantageScore has been so successful as an educational score offered by many free sites despite its differences from FICO.

While consumers may often have to pay to get their FICO score, they can monitor their credit and get a good idea of what is affecting their score for free using consumer websites that employ VantageScore. They can then take action that will help improve both their VantageScore and their FICO score.

Therefore, for general credit-building purposes, VantageScore is just as useful as FICO.

That said, it is important to keep in mind that most lenders still use FICO scores and many use earlier versions of FICO, which may be less comparable to VantageScore credit scores. If you are applying for a mortgage soon, for example, you’ll probably want to pull your FICO score in addition to your VantageScore, since mortgage lenders overwhelmingly use FICO in their lending decisions.

VantageScore and FICO scores are both important to get to know as a consumer, especially as VantageScore gradually becomes more popular with lenders.

What do you think about the VantageScore credit score? Have you compared yours to your FICO score? We’d love to hear your thoughts in the comments.

Read more: tradelinesupply.com