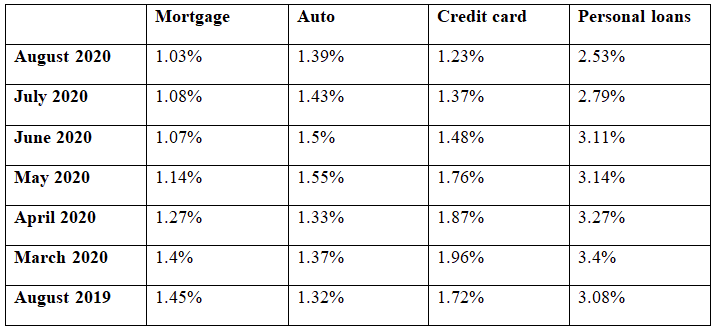

Mortgage approvals, overdrafts and consumer credit remain below 2019 levels

Household demand for mortgages and consumer credit remains below 2019 levels due to the shock of Covid-19 a report from the Central Bank states. The Central Bank has today published a special edition of the Household Credit Market Report providing … Continue reading →

Read more: creditandcollectionnews.com